Machine learning in real estate: use cases, examples & adoption guidelines

October 24, 2025

- Home

- Machine learning

- Real estate

Head of AI/ML Center of Excellence

With 5+ years in machine learning development services, Itransition helps real estate firms adopt scalable and secure ML solutions to automate routine processes, reduce operational inefficiencies, and enhance strategic decision-making.

Table of contents

Eight common ML use cases in real estate

Machine learning has become a key technological driver in the real estate industry, powering property valuation models, market trend forecasting, customer analytics, and process automation across platforms and corporate systems.

1 Real estate appraisal

2 Portfolio management

3 Targeted advertising

4 Property matching

ML-based recommender systems implemented on major real estate platforms provide customers with tailored property suggestions based on their prior search behavior, viewing history, and stated preferences. Much like recommendation tools deployed in retail or entertainment, the aim of these engines is to streamline the search process by guiding users toward assets that closely align with their needs and requirements.

5 Chatbots

6 Asset monitoring

ML solutions help continuously monitor the performance of key components of a property, including HVAC units, electrical systems, and elevators, identify any outliers, forecast potential failures, and enable predictive maintenance. These ML tools not only prevent costly equipment downtime, but also help optimize power consumption by spotting any deviations from normal conditions, such as abnormal spikes in energy usage or performance inefficiencies.

7 Fraud detection

Real estate enterprises can leverage ML tools to safeguard their business operations from fraudulent activities and streamline KYC procedures. Powered by machine learning algorithms, fraud detection systems analyze large volumes of financial, behavioral, and identity data, such as payment histories, criminal records, and credit scores of potential partners, tenants, or customers, to identify inconsistencies and flag suspicious transactions.

8 Finance & accounting

Enhanced with NLP capabilities and superior context understanding, RPA bots in real estate can replace or assist managers and accountants in performing a wide range of clerical tasks. Automatable processes include tax billing and reporting, lease contract processing, tenant onboarding, bank reconciliation, AR/AP, and NAV calculations. These intelligent systems improve accuracy, reduce manual workload, and accelerate financial operations, allowing specialists to focus on higher-value analytical and strategic activities.

Ready to enhance your business with machine learning?

Real-life examples of ML in real estate

Redfin implemented an ML-powered real estate appraisal system enabling users to estimate the market value of their properties based on over 500 metrics, including buyer demand and neighboring home prices. The tool estimates around 92 million properties across the US, showing a valuation accuracy of 98% for on-market homes and 93% for off-market assets.

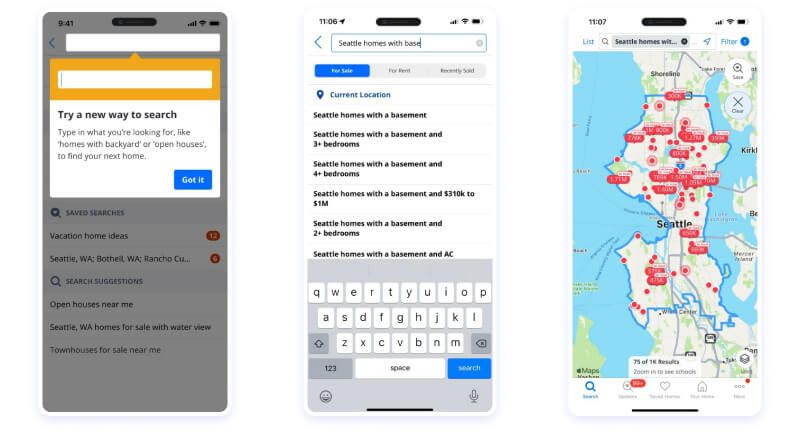

Zillow recently equipped its real estate platform with an advanced NLP feature powered by ML algorithms to answer search queries more efficiently. This solution can understand human-like communication, sift through millions of real estate listings, and recommend properties with features matching the descriptions provided by users in the search bar.

Image title: Zillow’s search feature interface

Data source: Zillow

This Israeli-based PropTech company created a commercial real estate analytics platform capable of processing real-estate data points gathered from hundreds of sources and covering over 400,000 assets to provide actionable insights. Skyline's ML-driven solution can also identify emerging real estate market trends, pinpoint untapped opportunities, and help firms make profitable investments.

Gridium developed an ML-based data analytics solution to optimize properties' energy consumption, reduce their environmental footprint, and streamline maintenance operations. By adopting this tool, real estate investor KBS saved $47,000 in electricity costs and other operating expenses at the Premier Office Towers in Emeryville, California.

ML adoption roadmap for real estate companies

The path to implementing machine learning can vary depending on the ML use case and the type of solution selected. However, most projects follow a similar sequence of steps outlined below.

1

Business analysis

2

Initial data analysis

3

Product design

4

Building the ML solution

5

Model integration & deployment

The development phase involves implementing both the front-end and back-end components of the solution and embedding the trained ML model into the software architecture to activate its intelligent capabilities. The project team should also configure all necessary API- or ESB-based integrations to integrate data from other applications and IoT sensors. Cloud data integration tools can help in this regard. Then, the ML solution is deployed to the selected on-premises or cloud-based environment.

6

Support

Benefits of ML in real estate

Broader data insights

Machine learning technologies like NLP and computer vision help collect and analyze vast amounts of real estate and market data from diverse sources. Such an expanded data pool provides analysts with a wider set of real estate-related metrics to better interpret trends and uncover deeper insights.

Superior valuation accuracy

ML-powered Automated Valuation Models (AVM) deliver high-precision property assessment, providing accurate insights for better investment and pricing decisions.

Increased sales performance

ML solutions encompass powerful tools, such as recommendation engines, to route customers toward suitable listings, along with features and techniques to drive sales, including user segmentation, targeted advertising, and lead scoring.

Cost reduction

From the automation of time-consuming clerical processes via software bots to power consumption monitoring through data analytics platforms, machine learning solutions help real estate organizations to optimize their budgets and resources.

Improved customer experience

Machine learning software enhances user experience across the real estate journey, from AI chatbots and virtual assistants providing instant support to platforms offering personalized recommendations, simplified search, and immersive virtual property tours.

Risk mitigation

ML systems' anomaly detection and predictive analytics capabilities safeguard real estate businesses from various financial risks, including fraud and market volatility. Additionally, predictive maintenance systems contribute to safer, more reliable property management.

Partner with Itransition to bring your machine learning project to life

Current challenges of using ML in real estate

While machine learning benefits your business, implementing it can involve various business and technical complexities. Here are some tips to overcome typical obstacles and streamline ML adoption.

Issue

One of the key challenges in the early stages of machine learning adoption is identifying the right use case, specifically, determining where an ML solution provides a clear advantage over conventional technologies. This decision is critical, as it directly influences technology ROI and affects executives’ buy-in.

Recommendations

Because ML development typically requires substantial resources for model training, data processing, and infrastructure, it’s most effective when applied to high-impact business areas. Focusing on such use cases as market and asset targeting, operational optimization, portfolio management, property valuation, and partner selection allows companies to maximize ROI and ensure meaningful, scalable results from ML adoption.

Data collection

Issue

Beyond obvious parameters, such as square footage, number of rooms, listing duration, and comparable home prices, the attractiveness of a real estate asset is also shaped by numerous less apparent variables. The challenge lies in identifying reliable data sources and processing vast, heterogeneous datasets to extract actionable insights.

Recommendations

To accurately define property value, realtors and other real estate professionals increasingly rely on ML-powered technologies for automated data collection from diverse data sources, such as social media, market studies, demographic reports, satellite imagery, and review platforms. Non-traditional parameters, such as the quality of local services, employment opportunities, and crime rate, are now combined with information from public real estate databases and corporate systems like real estate ERP or CRM to support comprehensive, data-driven property analysis.

ML model reliability

Issue

Machine learning models can produce inaccurate predictions if trained on outdated or low-quality data, potentially leading to costly decisions. Common causes include overfitting, which occurs when a model learns too narrowly from its training data, and model drift, which happens when performance declines as input data changes over time. Ensuring ongoing reliability and relevance is therefore a key challenge in ML system operation.

Recommendations

Model accuracy can be strengthened through robust data management practices, which includes data cleansing, ETL-based transformations, and metadata management. Splitting datasets into training, validation, and test subsets and ensuring they are not mixed up helps minimize overfitting, while continuous monitoring and retraining with updated data mitigate model drift.

Scheme title: AWS-based training pipeline for an ML-powered real estate platform

Data source: AWS — Machine Learning Infrastructure for Commercial Real Estate Insights Platform

Data privacy & security

Issue

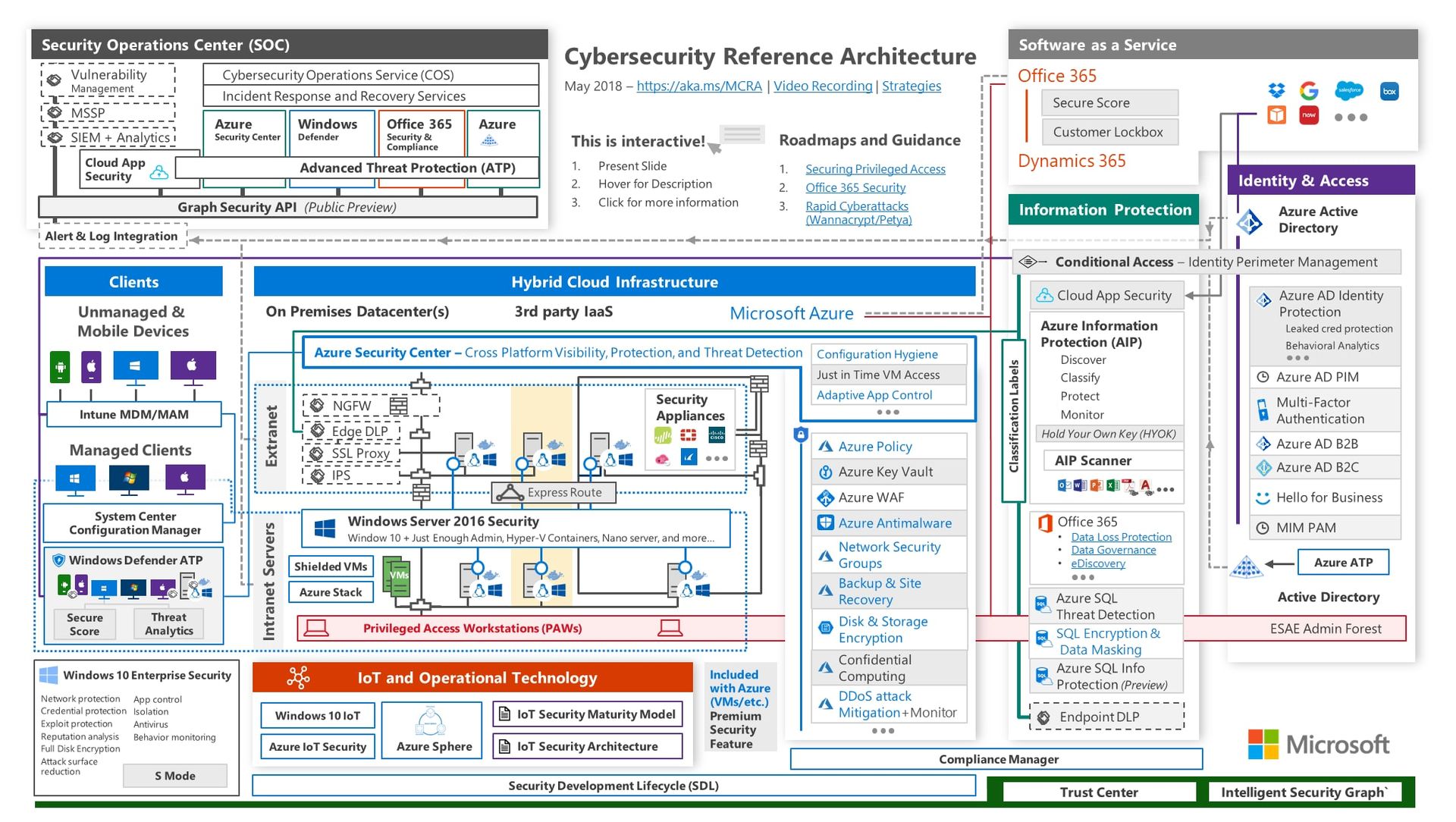

Given the amount of sensitive information, including financial data, that machine learning and artificial intelligence software for real estate needs to handle, organizations become potential targets for breaches, leaks, and cyberattacks. Integrations with external systems and IoT devices further expand the range of points of vulnerability. Therefore, poor data security can adversely affect business operations and corporate reputation and draw the attention of financial authorities and regulators.

Recommendations

Ensuring compliance with applicable standards and regulations, such as GDPR and CCPA, is essential. ML systems should incorporate strong cybersecurity measures, including identity and access management, multi-factor authentication, real-time event monitoring, and user activity tracking. Secure data exchange should rely on cryptographic protocols, such as Transport Layer Security, X.509 certificates, or symmetric keys. Complementing these controls with a robust data governance framework and internal security policies further enhances organizational resilience against cyber threats, data breaches, and operational disruptions.

Image title: Microsoft’s cybersecurity reference architecture

Data source: Microsoft — Cybersecurity Reference Architecture: Security for a Hybrid Enterprise

Machine learning reshaping the real estate sector

Just a few years ago, financial organizations such as Morgan Stanley defined real estate as one of the least digitized sectors. More recently, however, this industry has come a long way in implementing the most advanced applications of artificial intelligence and machine learning to improve decision-making, automate processes, and provide better services.

Despite these advances, many organizations still encounter difficulties driven by the black-box, data-driven nature of machine learning. Engaging experienced ML consultants such as Itransition can help address these challenges and ensure tangible business outcomes.

FAQs

What is machine learning in commercial real estate?

Machine learning in commercial real estate refers to the use of advanced algorithms and data-driven models to automate routine, effort-intensive processes, such as property valuation, investment analysis, tenant and lease matching, portfolio optimization, and maintenance scheduling. ML systems for real estate also analyze historical and real-time data, such as property details, market trends, tenant behavior, and economic indicators, to predict property values, optimize investment strategies, and enhance tenant experiences, supporting informed decision-making across the enterprise.

What ML tools can be used for real estate?

Real estate organizations can leverage a variety of ML and AI tools to improve operational efficiency and decision-making:

- Predictive analytics software to forecast market trends, occupancy rates, and property valuations

- Recommendation systems to match tenants or buyers with properties based on preferences and historical data

- Computer vision systems to analyze images and videos of properties for inspections and assessments

- Conversational AI solutions, such as AI-powered chatbots and virtual assistants, for 24/7 customer support and automated routine interactions

How much does machine learning implementation cost?

ML implementation costs for real estate vary significantly based on several factors, including the number of data sources, data type and volume, required algorithm accuracy, and infrastructure requirements. Basic proof-of-concept implementations can start at around $10,000, while enterprise-level systems typically range between $200,000 and $350,000. Additional expenses can include ongoing maintenance, model retraining, and infrastructure scaling.

.jpg)

Insights

Predictive analytics in real estate: use cases, popular tools & adoption challenges

Explore key applications, popular tools, and payoffs of predictive analytics in real estate, along with adoption challenges and guidelines to address them.

Service

Real estate data analytics

Learn about real estate data analytics use cases, metrics, and development essentials as you explore Itransition's range of data-centric services.

Service

Real estate portals: development services and successful examples

Ready to invest in real estate portal development? Check out portal types, essential features, and the best implementation examples.

Case study

Real estate sales automation software development

Learn how Itransition built a real estate sales solution with a data autocompletion feature, an admin panel, and a mobile-friendly interface.

Insights

RPA in real estate: 10 use cases, platforms & best practices

Explore the use cases of agentic automation and RPA in real estate, process automation benefits, and guidelines for implementing the technology effectively.

Insights

Machine learning for stock market prediction: applications & technical overview

Explore the role of machine learning in stock market prediction, including use cases, implementation examples and guidelines, platforms, and the best algorithms.

Case study

Custom ML algorithms for an insurance platform

We developed and trained an AI model that predicts insurance application conversion, helping the customer select targeted user price policies and discounts.

More about machine learning services

Services

Industries