Services

SERVICES

SOLUTIONS

TECHNOLOGIES

Industries

Insights

TRENDING TOPICS

INDUSTRY-RELATED TOPICS

OUR EXPERTS

February 5, 2026

Real estate professionals have long been relying on automated valuation models (AVMs) powered by statistical algorithms to value properties. Modern predictive analytics solutions powered by machine learning technology are a further step forward from AVMs, enabling real estate firms to assess how various variables impact an asset's price. Furthermore, ML-powered systems can spot correlations across a wider range of metrics, including traditional parameters like square footage or average property value in the local market and non-traditional ones such as the quality of local services or crime rate, to achieve maximum accuracy of the evaluation.

Global and local market conditions have a huge impact on property value and demand. Predictive analytics software helps realtors analyze economic indicators like interest rates, demographic factors like population migration, and many other metrics to forecast future market trends such as property or rental price fluctuations. For instance, a system can predict a rise in rent prices in a given area thanks to tech job growth, but also a long-term decline due to high vacancies, as these high-income professionals choose to buy properties rather than pay ever-increasing rents. This enables real estate firms to optimize their pricing and investment decisions.

Predictive analytics solutions help real estate investors build profitable and well-balanced portfolios by forecasting what properties would most likely appreciate in price or generate high rental income. These tools can also recommend asset improvements, such as interior renovations and energy efficiency upgrades, that would maximize the property's value. Furthermore, investors can also leverage these systems to diversify their portfolios by property type, location, tenant type, and other parameters, mitigating the negative impact of market volatility, default, and other trends or outcomes. For example, the system can identify the departure of corporations and property rezoning as the main investment risks in a certain area, with the former primarily impacting the value of office buildings and the latter having a greater effect on family homes, and thus recommend a mix of investments to minimize losses, whatever the scenario.

Marketers in the real estate sector can use predictive segmentation tools to group potential clients by expected behavior, such as their likelihood to respond to certain marketing messages or be interested in particular types of properties, based on past browsing or purchasing history and personal details. This facilitates the creation of targeted ad campaigns across social media and other channels to focus marketing efforts on high-value segments. Predictive lead scoring tools, often integrated into AI-powered CRM software, follow a similar approach to foster lead generation. In this case, the system suggests leads that are most likely to convert into clients based on their personal attributes and behavioral patterns.

By adopting building management systems equipped with predictive capabilities, property managers and owners can embrace a more proactive approach to asset maintenance. These systems can monitor the state and performance of mechanical, electrical, and plumbing (MEP) systems, such as HVAC units or elevators, to identify signs of component degradation and predict impending failures. For instance, a predictive maintenance solution can analyze real-time data collected from an elevator motor via IoT sensors, spotting abnormal vibrations or spikes in energy usage with the help of ML-based anomaly detection algorithms and therefore triggering an alert.

Real estate companies typically face a variety of business risks when dealing with clients. When it comes to tenant credit risk, predictive analytics systems help organizations assess clients’ creditworthiness and forecast the likelihood of delinquency based on factors like income stability, available liquidity, and payment history. As for fraud risk, predictive anomaly detection tools can spot suspicious behavioral patterns, such as inconsistencies in submitted financial documents, enabling businesses to prevent deals with loan fraudsters or other malicious actors.

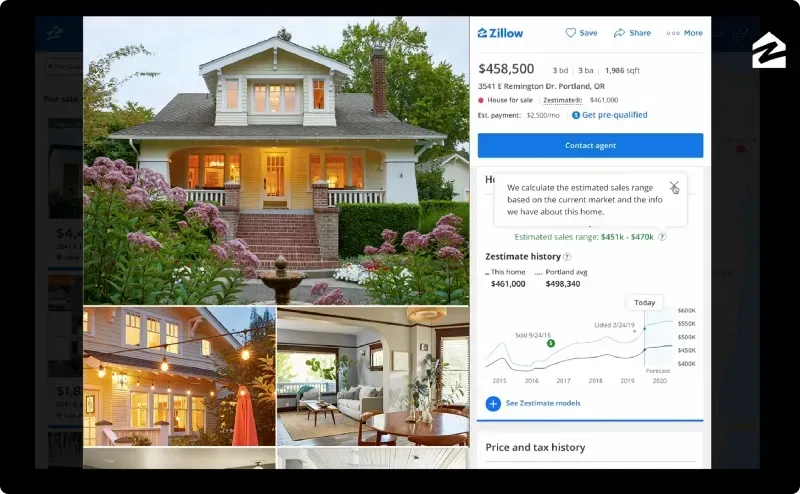

Launched in 2006 and gradually improved over time, Zillow's home valuation tool uses a proprietary machine learning model powered by neural networks to predict a property's potential market value. Factors taken into account include property features such as square footage, the price of comparable homes nearby, and market trends like seasonal changes in demand. The solution gathers this information from hundreds of listing services, tax assessor records, and other sources, providing estimates the accuracy of which depends on data availability in a certain area but is generally considered to be very high. In many US metropolitan areas, for instance, the difference between Zestimate’s predictions and actual transaction prices is less than 5% for over 90% of homes sold. Factors taken into account include property features such as square footage, the price of comparable homes nearby, and market trends like seasonal changes in demand.

Image title: Zillow Zestimate tool for property valuation

Image source: Zillow

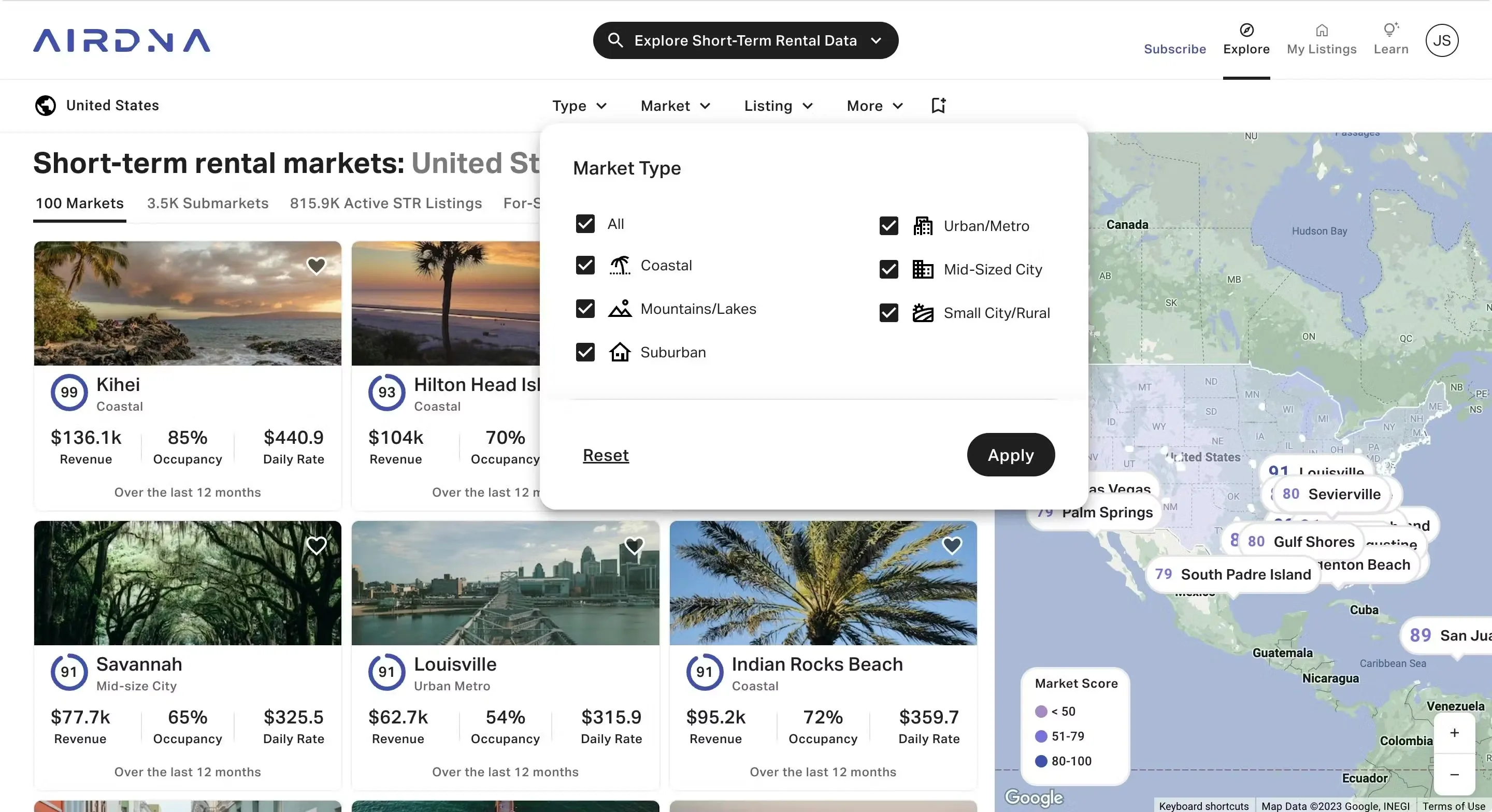

AirDNA is a real estate data analytics platform powered by machine learning algorithms and focusing on short-term rental properties. The solution analyzes a combination of booking data scraped from Airbnb and Vrbo and property information provided by the platform's partners, tracking the performance of over 11 million properties in total. This enables property owners or potential investors to explore vacation rental market trends, identify investment opportunities in specific locations, and optimize their listing prices based on rental demand, seasonality, and other metrics. The platform also features Rentalizer, a comprehensive Airbnb calculator that estimates the short-term rental revenue potential of any property, including its expected average daily rate, occupancy rate, and seasonality's impact on profits.

Image title: AirDNA’s dashboard for property performance tracking

Image source: AirDNA

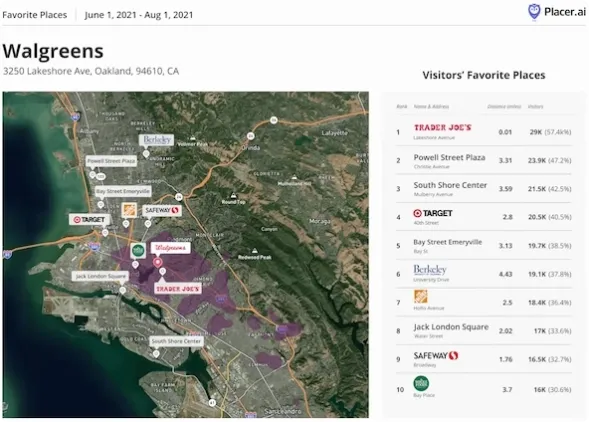

Placer.ai is a location intelligence platform that helps commercial real estate firms, retail and restaurant businesses, and other potential investors make more informed site selection and investment decisions based on consumer behavior. The system collects mobile app users’ location data from partnering data providers and tracks their movement and activity in relation to specific points of interest. Based on these traffic patterns and visit trends, companies can assess consumer habits and predict which location would be most profitable for real estate investment and development or where their business is most likely to thrive.

Image title: Placer.ai’s visit trend monitoring dashboard

Image source: Placer.ai

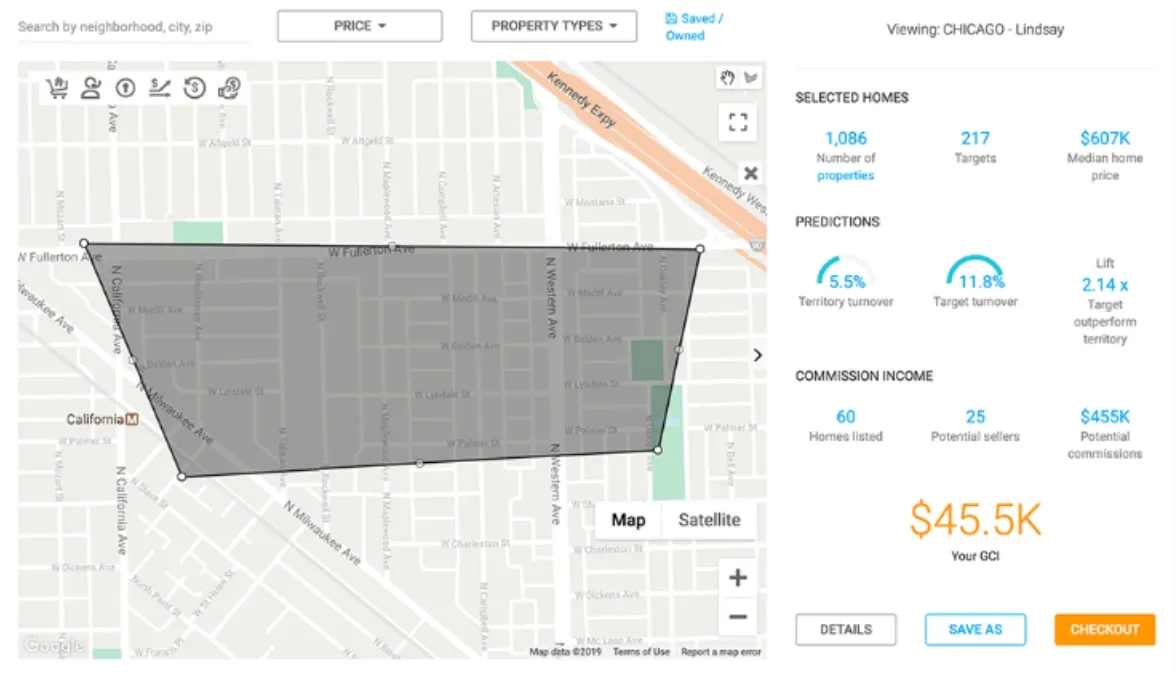

SmartZip is a lead generation and smart targeting tool that leverages predictive models to help realtors identify potential home sellers with over 70% accuracy. Companies can select a neighborhood or zip code, access a selection of qualified listing leads suggested by SmartZip based on behavioral and demographic data, and then use the platform’s built-in marketing automation features to connect with homeowners via email or online ads. This allows real estate agents to focus their efforts on the owners who are most likely to sell their properties

Image title: SmartZip’s neighborhood selection dashboard

Image source: SmartZip

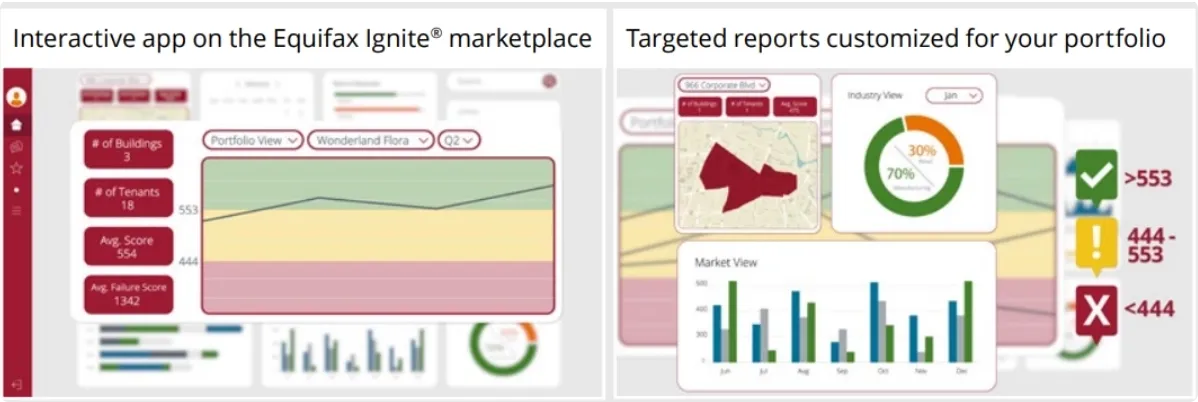

Commercial Real Estate Tenant Risk Assessment is a cloud-based software suite from the US credit reporting agency Equifax. The solution provides property managers, asset owners, and bankers with a 360-degree financial picture of their business tenants to predict real estate portfolio risks, including defaults, delinquencies, and vacancies. Businesses’ rent payment patterns are monitored on a monthly basis to identify changes and flag tenants with increased risk profiles. Real estate companies can also receive Commercial Credit History Reports on potential business tenants to facilitate the credit decisioning process.

Image title: CRE Tenant Risk Assessment’s core offering

Image source: Equifax

Predictive analytics tools provide insights that help companies streamline real estate workflows by focusing on high-value clients via lead scoring or proactively addressing asset issues with predictive maintenance.

Predictive models help real estate firms identify underpriced listings, areas with high development potential, and other opportunities to make more informed decisions on property pricing and investments.

With the help of predictive analytics tools, businesses can derive actionable insights into clients’ needs and expectations, engaging them with more relevant and personalized property recommendations.

Predictive analytics software enables companies to predict future outcomes that can negatively impact their business, such as tenant default or a drop in occupancy rate, ensuring more effective risk management.

Concerns | Recommendations | |

|---|---|---|

Data quality & availability |

AI-powered predictive analytics software requires large sets of high-quality data first for artificial

intelligence model training and, once deployed, to deliver accurate predictions. Accessing this data,

however, can be complex for many real estate companies, with datasets often siloed in dozens of Multiple

Listing Services, data broker databases, and other sources. Furthermore, data points can be obsolete,

incomplete, or in different formats.

| Create a comprehensive data readiness plan to make sure that your company’s data assets are accurate, complete, consistent, and accessible for your predictive analytics initiative. Your plan should define policies and procedures for data governance, including data quality checks to ensure data integrity. It should also outline suitable methods to integrate and access data in different formats and from multiple sources, such as ETL pipelines for very large datasets or data virtualization for accessing up-to-date data in real time. |

Predictive model bias & inaccuracies |

Predictive analytics systems powered by machine learning models typically outperform their non-AI

counterparts in terms of forecasting accuracy. However, these systems can still be prone to errors and bias.

For instance, an ML model trained on decades of sales data, in which properties in minority-populated areas

were systematically undervalued compared to white-populated areas, can generate discriminatory estimates.

| First, consider prioritizing low-risk predictive analytics use cases where errors have little impact on your business. For instance, incorrect lead scoring likely won't damage your reputation like unfair tenant screening. Second, you can use techniques like adversarial debiasing or reweighting to mitigate unwanted bias in a model's predictions. You can also rely on explainable AI techniques like SHAP and LIME to identify specific features impacting a prediction, such as proximity to a highway in property appraisals, helping human specialists cross-check the solution’s output. |

Data privacy & security |

Real estate predictive analytics solutions can handle large volumes of confidential information, such as

bank account details, credit history, and tax returns. This can raise privacy and security concerns among

clients and regulatory agencies, as well as attracting the attention of fraudsters and cybercriminals.

| Build custom predictive analytics solutions or adopt off-the-shelf software products operating in full compliance with applicable data management regulations, such as the GDPR and the data minimization and purpose limitation principles it promotes. As these regulations typically require companies to protect personal data from unauthorized access, you should also equip your software with robust security features, such as end-to-end encryption or identity and access management tools. Furthermore, consider using data masking techniques like shuffling or substitution to anonymize datasets for ML model training and thus ensure their confidentiality. |

Our consultants provide expert guidance at each stage of your predictive analytics initiative, assisting with business needs elicitation from stakeholders, data audit, software conceptualization, project planning and supervision, and user adoption.

We help you implement high-performance and secure predictive analytics solutions, taking care of software design, development, integration, testing, deployment, and post-release maintenance.

The real estate sector has made great strides in the past few years to fully harness the potential of predictive analytics, AI, and other advanced technologies. Nowadays, many real estate platforms and tools incorporate predictive functionality to help businesses navigate highly volatile and competitive markets. That said, these powerful capabilities should be used responsibly and ethically to minimize potential bias and comply with data regulations.

Rely on an experienced partner like Itransition to implement powerful and compliant predictive analytics solutions tailored to your business requirements.

Popular options for real estate data analysis include:

Predictive analytics solutions should be fuelled with big data sets of historical data and streams of real-time data to perform properly. This requires real estate firms to identify and leverage a combination of internal and third-party sources, including:

The role of predictive analytics in the real estate industry is evolving in line with emerging technological trends. Key aspects in this regard include:

Service

Learn about real estate data analytics use cases, metrics, and development essentials as you explore Itransition's range of data-centric services.

Insights

Explore the key trends, use cases, examples, and benefits of ML in real estate, along with common adoption challenges and best practices for addressing them.

Insights

Explore a definitive guide to ERP solutions for real estate, covering key features, integrations, top tools on the market, and the business value they offer.

Case study

Learn how Itransition built a real estate sales solution with a data autocompletion feature, an admin panel, and a mobile-friendly interface.

Case study

Find out more about Itransition’s property management portal design and development project for a UK-based startup.

Insights

Explore the use cases of agentic automation and RPA in real estate, process automation benefits, and guidelines for implementing the technology effectively.

Case study

Learn about Salesforce CRM implementation that helped a large real estate company increase their sales by 15% and shorten their sales cycle by 10%.

Insights

Discover key capabilities and benefits of Salesforce for real estate, along with real-life examples of Salesforce adoption and top Salesforce-based solutions.