Services

SERVICES

SOLUTIONS

TECHNOLOGIES

Industries

Insights

TRENDING TOPICS

INDUSTRY-RELATED TOPICS

OUR EXPERTS

December 2, 2025

Compared to traditional systems, which rely on limited sets of manually encoded rules to trigger a response, ML-powered fraud detection solutions autonomously recognize a wider range of anomalies that can be signs of fraudulent activities and ensure a lower rate of false negatives. Furthermore, these systems can identify new unconventional patterns and outliers as they process “fresh” data, learning to detect emerging threats. This results in faster and more cost-efficient fraud prevention operations.

AI systems can automatically assess the creditworthiness of customers asking for a loan, generating accurate risk profiles based on hundreds of parameters and the subtle relationships between them, which are difficult to identify for rule-based systems. This helps organizations minimize customer risk, speed up underwriting, and eliminate bias.

Using machine learning and deep learning algorithms, financial software can process data streams in real time to uncover non-linear patterns that rule-based systems would otherwise struggle to capture, allowing them to interpret and forecast complex market trends. Furthermore ML systems continuously learn from new data and adapt to evolving economic conditions to maintain predictive accuracy. This enables financial firms and private investors to continuously fine-tune their trading and investment strategies and maximize profits.

Banks and other financial organizations are increasingly relying on artificial intelligence to meet customer expectations for more intuitive and tailored services, establish meaningful connections with clients, and improve their engagement. AI-driven personalization goes far beyond simple segmentation rules, with systems designed to interpret each customer’s tone and sentiment across interactions to offer relevant and context-aware assistance.

Agentic AI solutions powered by generative AI outperform traditional software bots in automating financial and accounting workflows thanks to their superior context understanding and ability to handle exceptions (such as report inconsistencies). These tools can speed up document processing, data entry, and other clerical tasks while preventing human error.

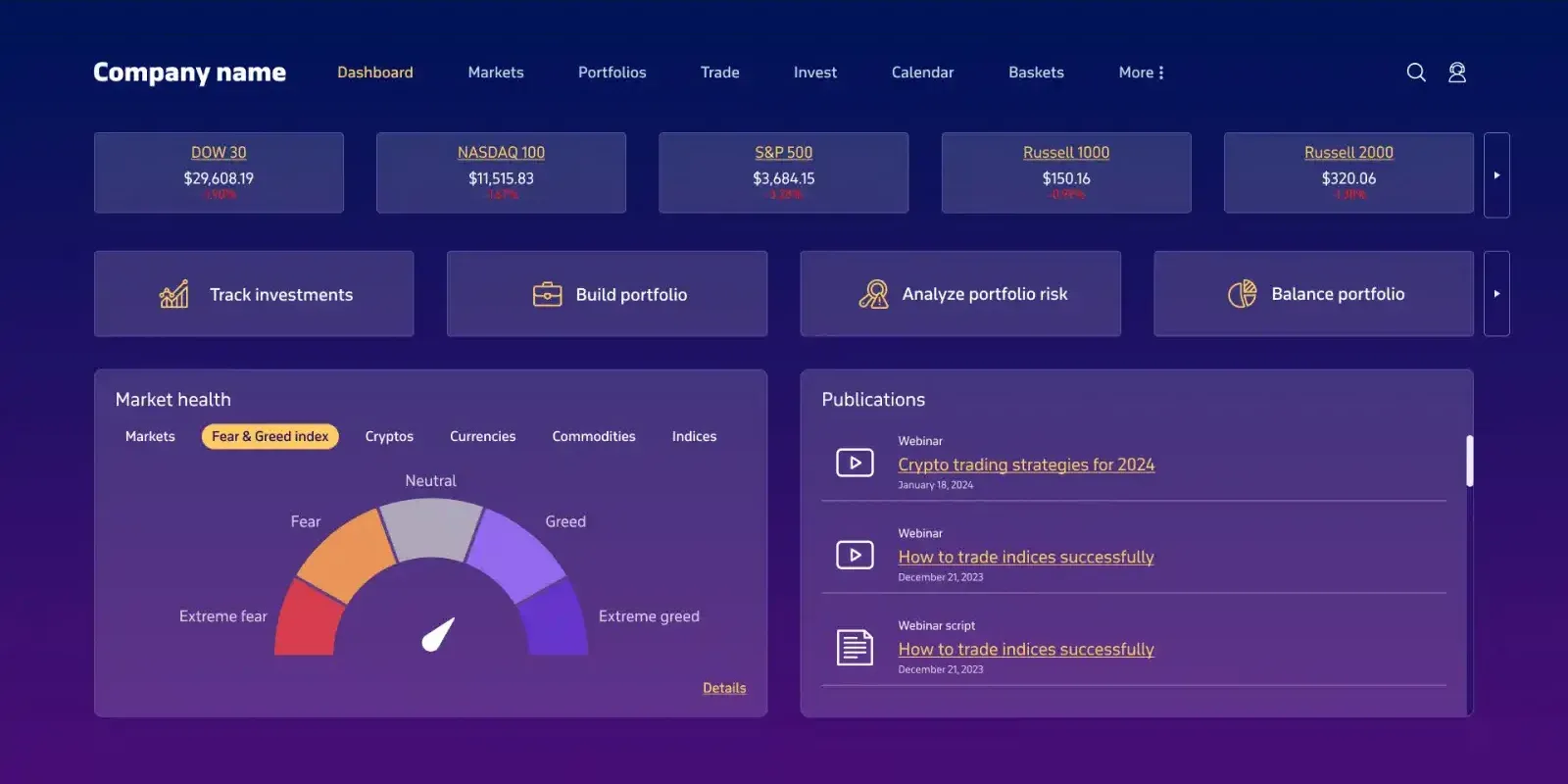

TradeSmith's flagship product is an investment portfolio management platform with predictive analytics capabilities that helps users monitor their investments and manage portfolio risk. The solution can analyze stock behavior, make ML-powered price and trend predictions, and notify users when the stock prices go up or down, suggesting the best time to close a position.

Image title: Dashboard

ComplyAdvantage offers a comprehensive fraud detection solution relying on machine learning models to identify various fraudulent scenarios, including identity theft, medical insurance scams, card flipping, and more. The system, deployed by financial services companies like Holvi and Banco Santander, can also track flows of illicit funds and spot clusters of fraudulent accounts controlled by a single criminal organization.

Temenos recently launched Product Manager Copilot, a GenAI-powered virtual assistant to help financial institutions design retail banking products aligned with customer expectations and relevant regulations. Product, IT, and customer service managers can derive insights into customer behavior and preferences, competitor offerings, and the regulatory landscape by interacting with the solution in natural language. Furthermore, the AI copilot can generate product descriptions and create test plans to assess new products.

Aimed at providing customers with a highly interactive user experience, the Bank of America integrated its mobile banking app with Erica, a virtual financial assistant powered by natural language processing. This advanced chatbot for customer support can monitor monthly spending and recurring charges, help replace stolen cards, send alerts and reminders, and track past transactions.

Capgemini’s AI.Receivables includes tools designed for frictionless cash and collections processes through AI-driven automation and analytics. This solution can help your workforce execute order-to-cash operations and predict which customers are likely to default, suggesting proactive measures to mitigate business risk. The potential outcome is a 40% improvement in days sales outstanding.

| The global AI in fintech market was estimated at $27 billion in 2024 and is expected to reach US$79.4 billion by 2030, growing at a CAGR of 19.7% | |

|---|---|

| The financial industry's AI spending is projected to grow from $35 billion in 2023 to $126.4 billion by 2027 |

Growth in AI platforms spend (2023-2024e)

Scheme title: AI platforms spend by industry

Data source: WEF

AI platforms spend/total revenues (2024e)

| In 2024, data analytics was the leading AI application among financial services firms (adopted by 57% of companies), followed by generative AI which saw the strongest year-over-year adoption growth | |

|---|---|

| In 2024, the top AI use cases that financial firms invested in included risk management (36%), portfolio optimization (29%), fraud detection (28%), and algorithmic trading (27%) | |

| Nearly three-quarters of companies already use AI in financial reporting, and this share is expected to rise to 99% by 2027 | |

| The top use cases for generative AI in terms of ROI are trading and portfolio optimization (cited by 25% of respondents), followed by customer experience and engagement (21%) |

| According to nearly 70% of financial services professionals surveyed, AI has driven a revenue increase of 5% or more. Furthermore, over 60% of respondents said AI has helped them reduce annual costs by 5% or more | |

|---|---|

| Financial services companies that have adopted artificial intelligence have seen an average 20% increase in productivity in software development, customer service, and other areas | |

| 37% percent of financial services professionals surveyed reported improved operational efficiency thanks to AI adoption, while 26% mentioned enhanced customer experience as a key benefit |

| 70% of financial services companies reported AI talent gaps across functions, especially in technical fields, risk management, andregulatory compliance | |

|---|---|

| 75% of financial services executives cite complex regulatory developments as the primary factor undermining confidence in AI investments |

Scheme title: Challenges of AI exploration in financial services

Data source:

NVIDIA

Artificial intelligence solutions can analyze larger volumes of data than traditional software and identify deeper and more complex dependencies, providing financial firms with accurate insights and predictions to make better trading, investment, and budgeting decisions.

While non-AI solutions driven by clear rules could automate relative straightforward operations, AI systems can now handle complex workflows by choosing the best course of action to achieve a set goal in full autonomy, helping companies further improve operational efficiency and mitigate related costs.

Modern solutions powered by conversational AI can handle 50-70% of customer interactions in full autonomy, enabling 24/7 support. Combined with AI-based customer analytics software, conversational AI tools can also deliver tailored service suggestions for more personalized experiences.

AI-based anomaly detection and predictive analytics systems enable financial organizations to assess and mitigate fraud, investment, and credit risks by accurately identifying outliers and forecasting future trends and occurrences.

AI implementation in the financial sector can be trickier than expected due to a combination of business and technical roadblocks. Here are some guidelines and best practices to overcome the most common adoption challenges.

Challenge | Solution | |

|---|---|---|

Data quality & availability |

Artificial intelligence is a data-driven technology. Any system powered by an AI model requires vast

amounts of data or streams of real-time information to be properly trained and to deliver accurate output.

|

|

Data privacy & cyber security |

In a highly regulated industry like finance, with organizations and service providers managing sensitive

information on a daily basis, the data-driven nature of AI can draw the attention of regulatory bodies and

raise privacy and security concerns among the customer base. Furthermore, it makes these solutions a

potential target for cyber attacks.

|

|

Workforce skill gap |

Many financial organizations can lack the in-house expertise to implement and take advantage of AI. At the

same time, the job market suffers from a general shortage of specialized talent, making recruitment more

difficult.

|

|

Management buy-in & ROI |

AI-powered solutions are typically more challenging, time-consuming, and financially demanding to

implement than traditional, non-AI software due to their complex architecture, long training process, and

substantial computing demands. This can make it more difficult to secure stakeholder and executive buy-in

and achieve the expected ROI.

|

|

Itransition offers end-to-end AI services to help financial companies build, adopt, and scale artificial intelligence solutions fully aligned with your business requirements.

Our consultants can help you address key aspects of your AI project, including business analysis, solution design, budgeting, and user adoption, to overcome potential roadblocks and speed up software delivery.

We deliver AI solutions that enable you to automate your operations and enhance decision-making, taking care of data preparation, AI model training, front-end and back-end development, software integration, and support.

Challenged by fierce competition, complex market dynamics, and customer demand for personalized user experiences, financial institutions have pinned their hopes on AI advancements, which are already delivering promising results across business domains.

That said, fintech companies and other organizations shouldn’t approach AI as a purely “plug-and-play” tool, since its successful implementation calls for expertise, ongoing human supervision, and interconnected IT environments. Consider relying on Itransition’s experience in AI-related projects to meet these requirements and facilitate AI adoption across your organization.

The use of AI enables financial institutions to boost revenues through service personalization, lower costs due to automation, and identify new business opportunities via data analysis, gaining a competitive edge in a crowded market landscape.

According to KPMG estimates, over 70% of organizations already rely on AI technology in finance, and 41% of them report using it to a moderate or high extent. However, adoption varies by region, with companies in North America, Asia-Pacific, and Europe leading the way.

Based on available surveys and reports, we can expect three major trends regarding the role of AI in financial technology and the financial services industry as a whole:

Insights

Explore predictive analytics use cases, real-life examples, and models for the financial sector, along with top platforms and implementation best practices.

Insights

Discover how wealth management software facilitates the provision of financial advice, improves asset management, and creates best-in-class investor experiences.

Insights

Explore how financial data analytics software helps businesses assess their financial performance, mitigate risks, and increase profitability.

Insights

Explore how business intelligence and data analytics benefit the financial services sector and learn what capabilities, integrations, and tools make up a successful BI strategy.

Case study

Learn how Itransition developed iOS and Android applications for a European bond trader with over $1 billion raised in funds for their clients.

Service

Itransition helps BFSI companies implement reliable, secure, and compliant fintech software that streamlines the delivery of financial and insurance services.

Services

Industries