Business intelligence for finance: capabilities, tools & integrations

December 3, 2024

- Home

- Business intelligence services

- BI for finance

Financial services companies generate massive amounts of data every day, yet extracting actionable insights is challenging with data scattered across heterogeneous systems and strict compliance requirements in place. This is where tailored business intelligence solutions for the financial sector can come in handy, solving these issues effectively.

How the financial sector uses business intelligence

Finance business intelligence has a variety of applications, from looking backward to assess financial performance in the past to forward-looking scenario planning and forecasting. Here, we have outlined some of the possible use cases of business intelligence for finance.

- Monitoring critical financial metrics, including return on assets, working capital ratio, return on equity and debt-equity ratio, net profit and net profit margin, cash conversion cycles, operating profit margins, and OPEX ratio

- Comparing actual financial performance with the planned one and drilling down into the reasons for any discrepancies

- Forecasting a company’s financial performance, operational efficiency, and bottom line (revenue, net income, costs, etc.)

- Value creation calculation

Strategic planning & budgeting

- Strategic financial planning (budget development, working capital management, risk management, resource management, succession planning, corporate tax planning)

- Developing and monitoring operational plans and budgets

- Creating what-if scenarios for business continuity planning

- Devising strategies to overcome potential challenges like unforeseen expenses, inflation, and cash flow disruptions

Product/service profitability analysis

- Monitoring important financial indicators like gross profit margin and operating profit margin to see the profit generated by a product/service and costs associated with it

- Determining the actual cost of a product, process, or service

- Identifying the most profitable products, services, customers, and customer segments

- Product and service pricing based on the competitor’s market analysis, discounts, demand, and customer purchase trends

Costs optimization

- Profit and loss reporting by customer or customer segment for acquiring, retaining, migrating, and growing the most profitable customers

- Analyzing historical expense trends and labor costs

- What-if scenarios and simulation analysis (adding or dropping products/services, adding new customers, changing delivery options, etc.)

- Profitability and cost variance analysis for identifying cost-reduction opportunities and determining profitability lever

Cash flow management

- Transaction monitoring, including deposits, withdrawals, claims, loans, and repayments

- Tracking quick ratio, current ratio, cash balance, and outstanding debts

- Accounts payable and accounts receivable forecasting

- Liquidity forecasting

- Scenario modeling for cash and liquidity ratios

Balance sheet management

- Tracking tangible and intangible asset performance, liabilities, and equity

- Optimizing assets and liabilities with forecasting and scenario analysis to ensure financial stability

- Managing working capital

- Balancing debt and equity levels

Customer intelligence

- Dynamic customer segmentation based on demographics, geography, or behavioral factors to personalize customer interactions

- Customer spending patterns analysis to identify potential customers/customer segments for cross-selling and upselling

- Uncovering the reasons behind customer churn to tailor products or services accordingly and manage churn

- Customer behavior modeling and predictive analytics to forecast customer needs

- Customer scoring for streamlined customer onboarding and predicting delinquency cases

Risk management

- Risk assessment and management, including credit, market, operational, and liquidity risks

- Analyzing risk exposure across multiple asset classes (stocks, bonds, cash equivalents, real estate, commodities, and cryptocurrency)

- Detailed analysis of potential deals and investments

- Simulating investment scenarios to identify the best investment opportunities

Compliance management

- Managing financial data for investigations, audits, and inspections

- Ensuring regulatory compliance of data storage

- Monitoring of financial data and activities for anomalies and fraud

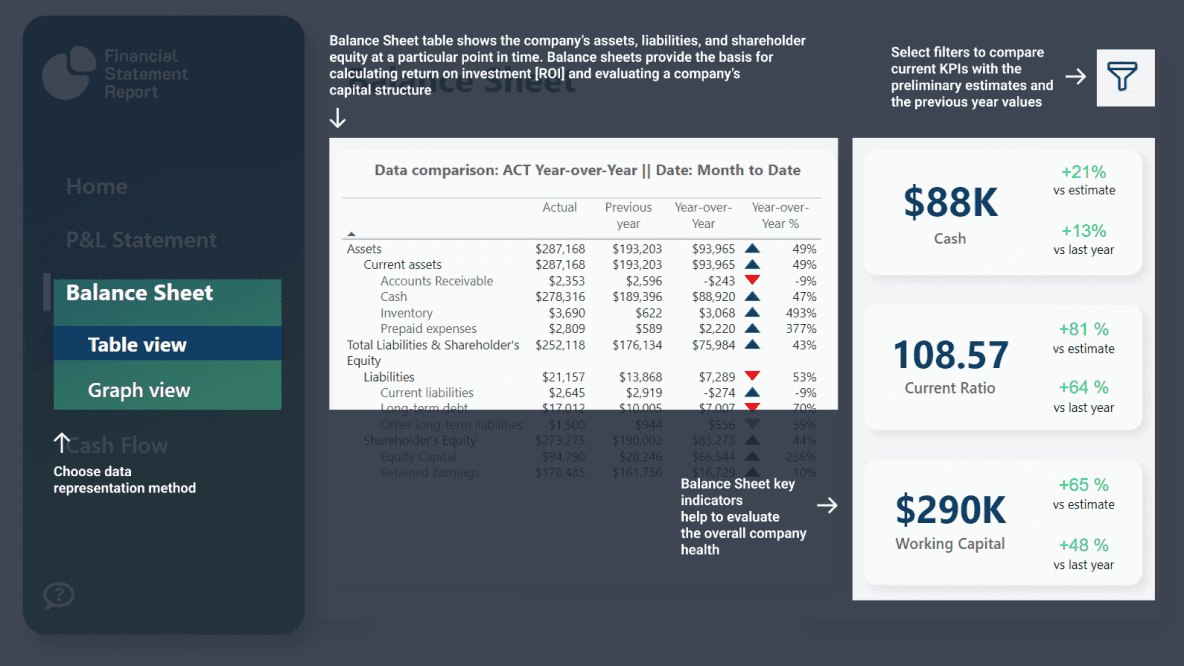

Financial KPIs at a glance

Have a look at a sample financial statement report prepared by Itransition’s BI department aimed at CFOs, financial departments, and C-level executives. It can be used to analyze the financial performance of a company as a whole or to get a granular view of key performance indicators for the needs of specific departments.

Real-life examples of BI in the financial industry

BI consulting & engineering for a commercial bank

The customer is a privately held Canadian bank focusing on reverse mortgages and financial solutions for retired homeowners. They needed to analyze their performance and evaluate the effectiveness of their products and wanted to develop a BI strategy and get BI suites consultations. Itransition assessed the customer's data architecture, workflows, and business processes and gathered user requirements. Next, the team developed a detailed BI implementation strategy based on the results and prepared recommendations for enhancing the existing data architecture. The team also performed data modeling, designed scalable data stores, redeveloped ETL operations, and conducted a detailed comparison of BI platforms to choose the optimal technology stack.

Stock trading software development for TradeSmith

The customer, one of the largest US-based providers of online investment and market research tools for individual investors and traders, approached Itransition to build an investment portfolio management ecosystem. Itransition delivered a set of financial technology tools for individual investors to monitor investments, analyze stock behavior, get notifications on the best investment opportunities, calculate the optimal size of investment based on actual stock data, and manage risks.

BI solution enhancement for InsightSoftware.com

InsightSoftware, a financial software company that delivers turnkey reporting and performance management solutions, approached Itransition to evolve its market-leading financial and operational reporting solution — InsightUnlimited™. Itransition improved the solution’s stability and report building performance, implemented the history tracking features, and performed integration with SAP. The implemented changes helped the customer decrease the report memory usage and reduce report opening time by 30%.

BI consulting & engineering for a commercial bank

The customer is a privately held Canadian bank focusing on reverse mortgages and financial solutions for retired homeowners. They needed to analyze their performance and evaluate the effectiveness of their products and wanted to develop a BI strategy and get BI suites consultations. Itransition assessed the customer's data architecture, workflows, and business processes and gathered user requirements. Next, the team developed a detailed BI implementation strategy based on the results and prepared recommendations for enhancing the existing data architecture. The team also performed data modeling, designed scalable data stores, redeveloped ETL operations, and conducted a detailed comparison of BI platforms to choose the optimal technology stack.

Stock trading software development for TradeSmith

The customer, one of the largest US-based providers of online investment and market research tools for individual investors and traders, approached Itransition to build an investment portfolio management ecosystem. Itransition delivered a set of financial technology tools for individual investors to monitor investments, analyze stock behavior, get notifications on the best investment opportunities, calculate the optimal size of investment based on actual stock data, and manage risks.

BI solution enhancement for InsightSoftware.com

InsightSoftware, a financial software company that delivers turnkey reporting and performance management solutions, approached Itransition to evolve its market-leading financial and operational reporting solution — InsightUnlimited™. Itransition improved the solution’s stability and report building performance, implemented the history tracking features, and performed integration with SAP. The implemented changes helped the customer decrease the report memory usage and reduce report opening time by 30%.

BI consulting & engineering for a commercial bank

The customer is a privately held Canadian bank focusing on reverse mortgages and financial solutions for retired homeowners. They needed to analyze their performance and evaluate the effectiveness of their products and wanted to develop a BI strategy and get BI suites consultations. Itransition assessed the customer's data architecture, workflows, and business processes and gathered user requirements. Next, the team developed a detailed BI implementation strategy based on the results and prepared recommendations for enhancing the existing data architecture. The team also performed data modeling, designed scalable data stores, redeveloped ETL operations, and conducted a detailed comparison of BI platforms to choose the optimal technology stack.

Stock trading software development for TradeSmith

The customer, one of the largest US-based providers of online investment and market research tools for individual investors and traders, approached Itransition to build an investment portfolio management ecosystem. Itransition delivered a set of financial technology tools for individual investors to monitor investments, analyze stock behavior, get notifications on the best investment opportunities, calculate the optimal size of investment based on actual stock data, and manage risks.

BI solution enhancement for InsightSoftware.com

InsightSoftware, a financial software company that delivers turnkey reporting and performance management solutions, approached Itransition to evolve its market-leading financial and operational reporting solution — InsightUnlimited™. Itransition improved the solution’s stability and report building performance, implemented the history tracking features, and performed integration with SAP. The implemented changes helped the customer decrease the report memory usage and reduce report opening time by 30%.

Looking for a trustworthy BI technology partner?

Top business intelligence tools for finance

We offer a list of current market leaders according to the 2024 Gartner Magic Quadrant for Analytics and Business Intelligence Platforms to help companies start looking for their future financial BI platform.

Power BI is an end-to-end BI platform that enables self-service business analytics at the enterprise scale. The tool offers more than 150 pre-built connectors that integrate with various data sources, including relational and non-relational databases, data warehouses, big data software, local files, and spreadsheets. The tool satisfies the analytics needs of non-tech users with self-service data preparation, analysis, reporting, and visualization, as well as the needs of skillful data analytics and data scientists. Power BI offers rich visualization and reporting capabilities and safeguards corporate data with row-level security, bring-your-own key support, and data encryption. The product is available as a SaaS option running in the Azure cloud or as an on-premises option in Power BI Report Server.

Product differentiation

- Augmented analytics capabilities, including intelligent narratives and anomaly detection capabilities

Platform pricing

- Power BI Desktop

- free

- Power BI Pro

- $10 per user/month

- Power BI Premium

- $20 per user/month

- Power BI Embedded

- from $1.0081/hour

- Free trial

- for 2 months

Limitations

- The on-premises version has functional gaps when compared with the cloud service

- Azure-only deployment

Tableau is a visual analytics platform that can be deployed in the cloud or on-premises. The platform offers native integrations with 80 data sources and supports self-service data preparation and no-code analytical data querying. Tableau is a user-friendly solution that caters to the needs of both power and casual users with visual data exploration, intuitive dashboard creation, NLP capabilities, and drag-and-drop capabilities. In addition, the tool enables enterprise-grade security by restricting user access with user filters and row-level security.

Product differentiation

- Intuitive analytics experience based on its patented VizQL engine, a user-friendly design

Platform pricing

- Tableau Creator

- $75/user/month

- Tableau Explorer

- $42/user/month

- Tableau Viewer

- $15/user/month

- Tableau Enterprise Creator

- $115/user/month

- Tableau Enterprise Explorer

- $70/user/month

- Tableau Enterprise Viewer

- $35/user/month

- Tableau+

- available upon request

- Free trial

Limitations

- High premium pricing

- A steep learning curve

Qlik Sense empowers business users at all skill levels to make better business decisions elevating data literacy with seamless connectivity to hundreds of data sources, automated data preparation, AI-generated analyses and insights, drag-and-drop report and dashboard creation, and NLP capabilities. In addition, Qlik Sense offers data storytelling capabilities, group sharing, collaboration, smart search, and automated ML capabilities. The tool also supports shared, managed, and personal spaces, as well as row- and column-level security.

Product differentiations

- Deployment flexibility, including cloud, multi-cloud, and on-premises installation

Platform pricing

- Standard

- $825/month

- Premium

- $2,500/month

- Enterprise

- custom pricing is available upon direct request

- Free trial

Limitations

- Product pricing complexity

Looker is a business intelligence platform by Google that helps organize business data and make it accessible and useful for employees. With Looker, users can also embed fully interactive dashboards into their software to quickly get valuable insights. Looker is highly flexible in terms of deployment and can be managed in Google Cloud or hosted in another cloud service or the company’s servers.

Product differentiations

- Google Cloud integration, generative AI capabilities, and Looker Studio integration for analysis and visualization of data

Platform pricing

Custom pricing for Standard, Enterprise, and Embed plans can be obtained upon request

- Free trial

Limitations

- Requires the knowledge of LookML, Looker’s proprietary language

- Intricate pricing structure

- Looker Studio row limit for the results displayed in the browser

Oracle Business Intelligence encompasses a comprehensive portfolio of business intelligence tools like Oracle Business Intelligence Suite Enterprise Edition Plus, Oracle Business Intelligence Server, Oracle Business Intelligence Publisher, Oracle Business Intelligence Answers, and so on. They provide capabilities like data mining, data warehousing, ad hoc queries, intelligent interaction, dashboards, financial reporting, and OLAP analysis. The platform offers an all-embracing range of options for information distribution, analysis, and access in a single, fully integrated web environment.

Product differentiation

- a single platform offering various capabilities for different business units in the organization

Platform pricing

- Oracle Business Intelligence Applications - Standalone

$250 for the license

$55 for the software update license and support

- Oracle Business Intelligence Applications, Fusion Edition (Siebel Analytics-based products)

from $5,800 for the license

$1,276 for the software update license and support for separate products

Limitations

- Not very user-friendly or customizable interface

- Performance bottlenecks and lags according to some user reviews

ThoughtSpot is a user-friendly BI tool that sets itself apart from traditional BI platforms by offering a conversational analytics experience powered by AI. Business users can integrate and process data from spreadsheets, CSV files, cloud data systems, and other information sources, ask questions in natural language, create interactive graphs, and customize pinboards, all without having to know SQL and other query languages. ThoughtSpot comes in two packages: ThoughtSpot Analytics (a standalone BI tool) and ThoughtSpot Embedded (a low-code embedded analytics platform allowing companies to enhance existing tools with BI capabilities).

Product differentiations

- a search-based, AI-powered user interface

Platform pricing

- ThoughtSpot Analytics Essentials

- $1,250/month

- ThoughtSpot Analytics Pro

- custom pricing is available upon request

- ThoughtSpot Analytics Enterprise

- custom pricing is available upon request

- ThoughtSpot Embedded Developer

- free for one year

- ThoughtSpot Embedded Pro

- custom pricing is available upon request

- ThoughtSpot Embedded Enterprise

- custom pricing is available upon request

- Free trial

Limitations

- Limited customization capabilities

- Limited embedding, integration, visualization, and interaction capabilities according to some user reviews

Financial BI selection criteria

Choosing the optimal BI technology is one of the major steps in a BI implementation project. This complex process is built on a comprehensive analysis of current and future business needs, goals, and expectations, which are unique for a company. However, the following functionality appears to be beneficial for most companies in the financial sector:

Vast data integration capabilities

including pre-built connectors and easy-to-use APIs for consolidating data from internal and external systems located on-premises or in the cloud

Data management automation capabilities

including data ingestion, data transformation, and data quality management features

Advanced data governance & security management features

to safeguard data from breaches and leaks, as well as to ensure compliance with the strictest industry requirements

Augmented analytics capabilities

to automatically generate insights with machine learning techniques for end users

Self-service capabilities

including NLP support and a drag-and-drop user interface, to streamline analytics decision-making for end-users lacking tech expertise

Customization capabilities

to adjust to a company’s or particular department’s specific needs

Scalability

to extend in line with the company’s growth and data volume increase without compromising the performance

Real-time analytics & streaming data support

to handle time-sensitive data for quicker, data-driven responses

Collaboration features for all stakeholders

to be able to participate in report creation and share insights in the form of reports and dashboards with their colleagues

Common integrations for BI in the financial sector

Core integrations

Accounting software

Importing data on financial transactions across assets and liabilities for finance teams to:

- Monitor and measure the company's profitability with comprehensive financial reporting

- Forecast accounts payable and accounts receivable

- Assess financial performance drivers

- Forecast future financial scenarios

Customer relationship management (CRM) software

Exporting customer data, customer sentiment, and customer transactions to:

- Identify the most profitable customers and customer segments

- Effectively profile customers

- Develop new cross-selling and upselling marketing campaigns

- Uncover the reasons behind customer churn

- Track changes in customer behavior

Loan management software

Importing loan data and information on borrowers to:

- Track and measure average loan cycle time, amount, pull-through rate, average loan value, application approval rate, and the probability of default

- Identify target customers and improve customer acquisition

- Better manage delinquency

- Assist in loan servicing

- Forecast loan demand and loan profitability

Investment portfolio management software

Importing client profile and investment data to:

- Analyze existing and potential investments

- Identify optimal investment time and amount

- Analyze investment risks

- Build models to make strategic, data-driven investment decisions

- Forecast stock behavior and optimize financial portfolios

Invoice management software

Importing invoice data (date of issue, numerical data, payment terms, taxes, invoice processing status) to:

- Get an insight into the volume and statuses of invoices

- Identify the average time for a payment cycle, late payment, fraudulent payments, and duplicate payments

- Conduct invoice processing analytics to identify process bottlenecks and overpayments

- Forecast invoice payments

How business intelligence benefits financial organizations

Smart decision-making

BI tools help quickly derive actionable insights from the enormous amounts of disorganized data. Companies can analyze data sets from internal and external sources and make more efficient business decisions due to immediate access to business insights. At the push of a button, they can answer questions like: What was this quarter's performance? How does a chosen strategy impact the received profit? What is the status of the customer credit pipeline?

Increased customer lifetime value

Business intelligence software helps identify the most profitable customers and target them with new products and services, creating discount and customer loyalty programs to retain those in doubt. Additionally, business intelligence tools are helpful for tracking customer retention metrics such as customer churn, revenue churn, repeat purchase rate, and customer lifetime value.

Risk mitigation

Using real-time and historical financial data analysis along with market trends, BI software helps companies navigate the volatile market and successfully manage risks more confidently. For example, companies can timely identify fraudulent activity or discover prospective delinquency cases to mitigate accounts payable risk. Business intelligence tools also help monitor employee interaction with data and reports.

Personalized customer experience

Business intelligence software facilitates massive customer data capture, dynamic customer segmentation, and behavior data mining and analysis. It enables personalization of content, product and services, pricing, and expert advice to evoke cross-selling and upselling, build customer loyalty, and enhance customer experience.

Time savings

With many repetitive tasks on their hands, finance departments leverage BI tools to speed up data aggregation and financial analysis by automating data collection, entry, analysis, and control

Minimized errors

Manual collection and organization of large amounts of data from multiple sources is time-consuming and error-prone. Therefore, companies use BI software to increase trust in data, save time and ensure high data quality – with no duplication, inconsistency, and loss.

Elevated profitability

Financial business intelligence enables companies to collate massive data sets from disparate sources to find growth and cost-saving opportunities, as well as inefficiencies. Thanks to rational resource usage and budget allocation, companies are able to cut down on spending, thus enhancing their financial standing

Facilitated collaboration

Need help with implementing financial business intelligence within time and budget?

BI implementation cost factors

The cost of implementing and managing a BI solution consists of hardware, software and labor costs that are defined by the complexity of the BI solution. To get a ballpark estimate of the financial BI solution, you have to define the following:

- Data sources – their number, integration flexibility, deployment environment

- Data for analysis – its volume, structure, variability, and format

- Initial data quality and data quality requirements

- Data storage layer complexity, if it includes an enterprise data warehouse, data marts, complementary data storage

- Data analytics complexity including the number of entities, data flow complexity, if ML and AI are required, streaming financial analytics, and real-time data analytics

- Data visualization and reporting requirements, including embedded reporting, self-service BI, custom visualization, and mobile support

- Data security and compliance requirements

Finance BI: adoption challenges & their solutions

Unreliable data

Inaccurate, incomplete, inconsistent, and irrelevant data can ultimately compromise the usefulness of a BI system-generated report or dashboard.

Inaccurate, incomplete, inconsistent, and irrelevant data can ultimately compromise the usefulness of a BI system-generated report or dashboard.

To ensure sufficient and valid data enters the BI solution, a company should build a comprehensive data quality management framework. This framework guides the processes of:

- Data quality assessment

- Data profiling

- Data standardization

- Data transformation

- Data quality control

An inseparable part of the data quality management program is ensuring that users understand the importance of proper data management and actively participate in data quality management activities.

Responsible data democratization

BI propels data democratization, meaning that any authorized user can leverage business intelligence to make informed decisions. However, users can intentionally or unintentionally compromise data safety.

BI propels data democratization, meaning that any authorized user can leverage business intelligence to make informed decisions. However, users can intentionally or unintentionally compromise data safety.

An effective self-service BI solution is well-governed. To protect corporate data and ensure the derived analytics insights add value, comprehensive data governance policies and rules should be applied:

- Access to information based on user roles

- Dynamic data masking and end-to-end encryption of sensitive data

- Multi-factor user authentication options

- User activity monitoring

- Regular risk and vulnerability assessments

- Complete data audit trail

Lack of company-wide adoption

End-users resist the implementation of new software, even though it offers self-service capabilities such as interactive visualization with graphs or charts, NLP, and drag-and-drop interface, continuing to use familiar tools like Excel or legacy analytics applications.

End-users resist the implementation of new software, even though it offers self-service capabilities such as interactive visualization with graphs or charts, NLP, and drag-and-drop interface, continuing to use familiar tools like Excel or legacy analytics applications.

To help mitigate the issue, we recommend companies develop an algorithm for a smoother transition to new technology:

- Continuously monitor user activity and logs of user requests to identify potential adoption problems and issues

- When starting the deployment, find a relevant use case that demonstrates tangible benefits of the BI software and addresses specific pain points to encourage people to use the new software

- Promote data culture, support open communication, and encourage continuous learning by delivering role-based user training, educational videos, or other resources

Make financial BI a success with expert help

Finance is one of the most data-heavy industries, with a lot of information to process, analyze, and leverage generated daily. In this scenario, business intelligence becomes a key enabler for managing a financial organization successfully, gaining a competitive edge, and making data-driven decisions. However, according to a recent survey, the BI adoption rate in the industry is at most 50%. There are several reasons behind that, one of which is the need for a coherent BI implementation strategy and practical experience in selecting and implementing proper BI technology. If you're ready to adopt an effective BI solution and maximize its ROI, you can turn to Itransition’s certified BI consultants

FAQs

Can financial business intelligence be useful for small and medium-sized businesses?

Yes, financial business intelligence tools are becoming more and more accessible for small and medium-sized businesses. With the emergence of self-service BI capabilities, data analysis is getting democratized and user adoption across non-technical specialists is increasing. What is more, the proliferation of cloud-based solutions lowers the bar for companies with limited budgets, allowing for quicker BI tool deployment.

Does the integration of financial BI tools call for a complete infrastructure overhaul?

How do we start with financial BI?

What role does AI play in financial business intelligence?

Artificial intelligence is actively incorporated into varied industries, tools, and businesses. Being a major trend worldwide, AI can be applied to fintech, including financial business intelligence. AI-enabled BI tools help companies personalize financial services and offerings, anticipate market trends, and process larger and more complicated data sets like emails, texts, images, and other examples of unstructured information that were previously hard to analyze.

Insights

Machine learning for stock market prediction: applications & technical overview

Explore the role of machine learning in stock market prediction, including use cases, implementation examples and guidelines, platforms, and the best algorithms.

Insights

Predictive analytics in finance: use cases, platforms & adoption guidelines

Explore predictive analytics use cases, real-life examples, and models for the financial sector, along with top platforms and implementation best practices.

Insights

AI in fintech: use cases, solutions, trends & implementation challenges

Explore key areas of application, real-life examples, trends, and benefits of AI in fintech, along with adoption challenges and strategies to address them.

More about BI services

Services

Insights