Services

SERVICES

SOLUTIONS

TECHNOLOGIES

Industries

Insights

TRENDING TOPICS

INDUSTRY-RELATED TOPICS

OUR EXPERTS

December 4, 2025

Given the constant increase and growing impact of financial crime, it’s no surprise that fraud prevention is one of the most popular applications of machine learning in banking. Indeed, ML systems with anomaly detection capabilities are progressively replacing traditional tools that rely on predefined sets of rules to identify fraudulent transactions. These advanced solutions, on the other hand, can autonomously spot suspicious behavioral patterns that indicate fraudulent activity but may be overlooked by humans and not yet covered by specific rules, thus triggering an alert. This helps companies detect a wider range of fraud scenarios, including new types of threats, with superior accuracy. For instance, a machine learning-enabled fraud detection solution can flag unconventional buying patterns to identify credit card fraud or anomalous business-to-business transactions to detect money laundering.

Machine learning solutions for cybersecurity share the same approach as fraud prevention ones and are powered by anomaly detection algorithms that identify the signs of potential cyber threats before they escalate to security incidents. This helps banking institutions prevent data breaches and leaks of highly sensitive financial and customer information, fostering compliance with applicable data management regulations.

For example, AI cybersecurity solutions can detect anomalous behaviors that indicate a malware attempting to access a bank account, including subtle outliers like unusual keylogging activity that may not be identified by traditional systems relying on rigid rules. Additionally, AI systems can spot new behavioral anomalies by autonomously learning from data on successful and failed attacks to recognize emerging cyber threats. These tools can also be used more proactively, for instance, to uncover and address banking systems’ vulnerabilities through automated code reviews, cyberattack simulations or “red teaming”, and AI-powered software patching.

Banks can greatly benefit from using predictive analytics systems powered by machine learning algorithms for credit scoring. These fintech solutions can quickly analyze thousands of data points from clients’ tax returns, payment history, credit inquiries, and other sources and assess each borrower’s creditworthiness and associated default risk without human bias. Additionally, these tools can recommend an appropriate credit limit based on the customer's disposable income to maximize the likelihood of on-time loan payments, as well as suggest an optimal interest rate that balances profit and customer satisfaction.

Investment banks, wealth management firms, and other financial institutions are increasingly implementing machine learning-powered predictive capabilities into their trading management tools to optimize their strategies and financial portfolios. Machine learning algorithms enable organizations to process big data sets or streams of real-time financial data to quickly and accurately forecast market trends, helping pick promising stocks and build balanced portfolios for their clients.

The access to ML technology, however, is no longer the exclusive preserve of professionals, as banks have begun integrating robo-advisors into their mobile apps and platforms to provide retail investors with automated financial advice and assistance. These AI agents can create personalized financial plans based on users’ investment goals and risk tolerance and then handle portfolio management operations such as asset allocation and diversification.

With the advent of AI technologies like natural language processing (NLP) and generative AI, the range of routine tasks that banking institutions can automate has expanded significantly, enabling them to minimize clerical workloads and allocate more resources to customer engagement and decision-making. For instance, ML-powered GenAI agents can help employees draft emails, create banking service descriptions, generate and summarize contracts, bank statements, or other documents, and transcribe online meetings with clients and colleagues to turn them into brief reports.

In recent years, the integration of generative AI tools such as AI agents to automate customer operations has become the major selling point for many popular CRM platforms. Relying on ML tools integrated into a banking CRM solution, marketing and sales departments can better segment their audience to effectively engage them with targeted ads and personalized financial product or service recommendations, boosting lead acquisition and conversion. At the same time, customer support teams can use chatbots and agentic AI tools to provide clients with instant, 24/7 assistance and speed up case resolution, for instance, guiding a client through replacing a stolen card.

In a highly regulated industry like banking, compliance with financial legislation is essential to prevent fines, legal liability, and reputational damage, so many institutions have started applying ML-powered tools to automate their compliance management workflows. For instance, these solutions can extract and summarize investment guidelines from Investment Management Agreements, Statements of Additional Information, and other documents. Furthermore, these tools streamline Know Your Customer operations by analyzing customer data (the source of funds and wealth, the number of accounts, transaction history, etc.) and assigning a risk score to each client.

London-based universal bank HSBC teamed up with Google Cloud to replace its rule-based tool for anti-money laundering (AML) with a faster and more accurate solution powered by machine learning. The new cloud-based system, named Dynamic Risk Assessment, can identify suspicious behavioral patterns, such as a rapid movement of funds across different accounts, to recognize potential cases of money laundering. Since implementation, HSBC reduced false positives by 60% and identified two to four times more financial crime incidents, while preventing any misuse of artificial intelligence through responsible AI practices.

While powerful, AI can also be misused and each deployment option presents trade-offs. To mitigate these risks, we adopt responsible practices, prioritise transparency and continuously assess the impact of AI on our customers and beyond. Responsible use of AI is at the forefront of our design choices as we seek to increase our use of these new technologies.

The US car financing branch of Banco Santander implemented an ML-powered credit risk analysis system to optimize its auto lending lifecycle. The solution helps Santander assess the probability of credit default and thus speed up the approval or denial of auto loans. Additionally, it enables the company to quickly adjust risk and pricing models based on evolving market conditions like interest rates and vehicle prices, automating the previously manual and time-consuming calibration process.

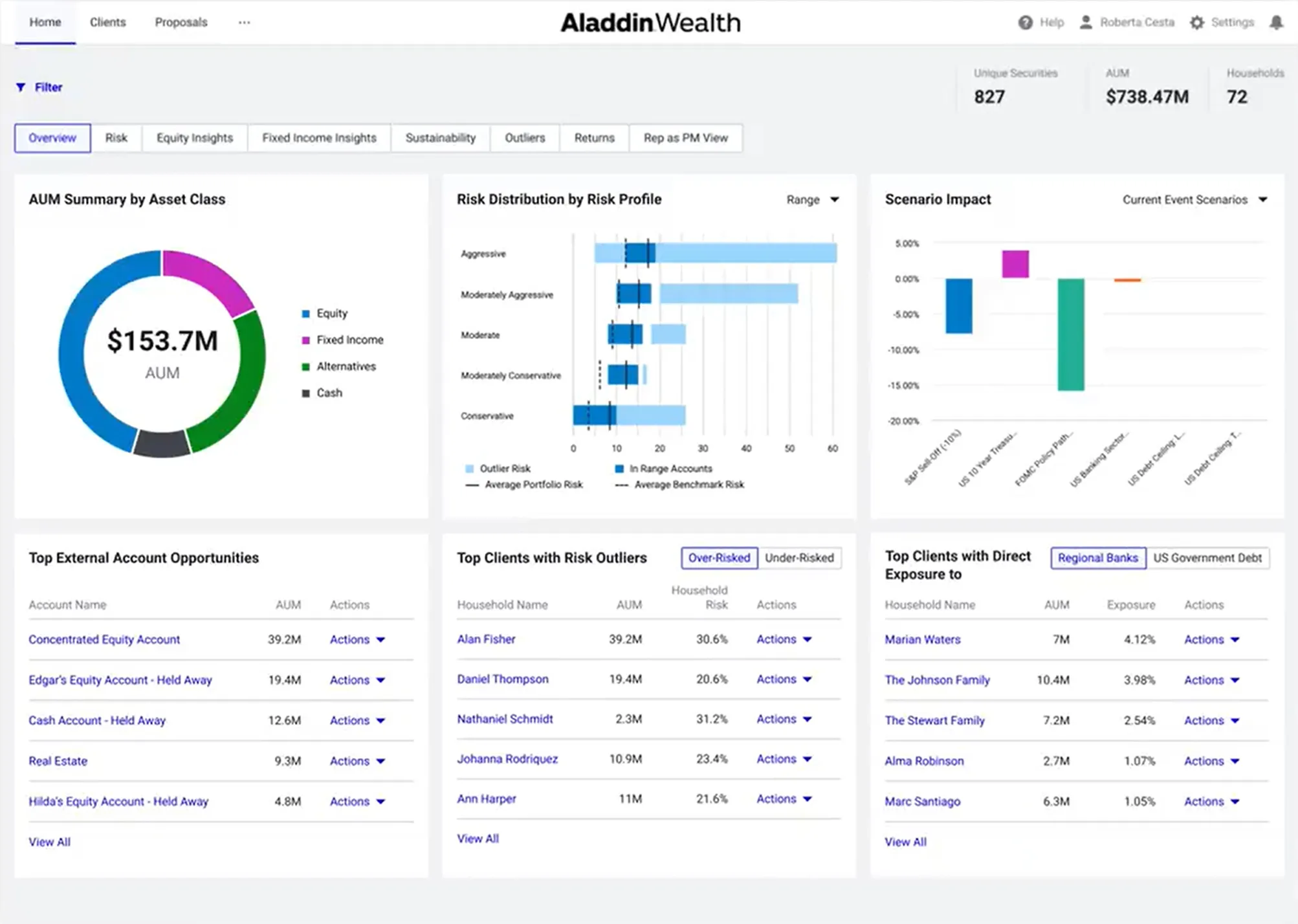

Aladdin is an investment technology platform developed by BlackRock and used by both the company itself and by central banks, wealth management firms, and other financial institutions worldwide. The solution, which uses Microsoft Azure’s machine learning and data management services, provides users with advanced analytics tools to better manage trades and portfolios and mitigate investment risk. Furthermore, BlackRock has recently enhanced its platform with new GenAI capabilities to summarize complex portfolio analyses into concise reports, assisting financial advisors in their research efforts.

Image title: Aladdin’s dashboard for investment proposal generation

Image source:

BlackRock

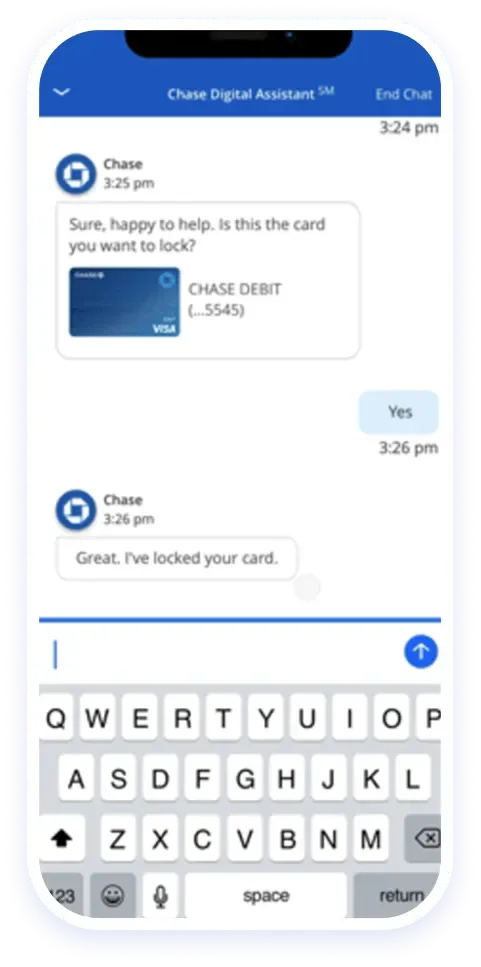

JPMorgan's consumer and commercial banking subsidiary Chase integrated a conversational AI tool into its mobile app to answer clients' inquiries in real time and assist them with various tasks. For instance, the virtual assistant can help users lock or replace credit cards, access account numbers or balances, monitor investment watchlists, and navigate the app to quickly find specific functionalities. When unable to answer a question, the assistant will automatically provide users with a telephone contact to receive support from a human specialist.

Image title: Chase Digital Assistant’s user interface

Image source: Chase

American financial services company Wells Fargo adopted a machine learning solution based on the Pega platform to provide its 70 million customers with more personalized communications. Based on past customer interactions and personal details, the engine offers next best conversation suggestions to help bankers engage each client with targeted and relevant messages through the preferred channel. Thanks to this solution, Wells Fargo increased customer engagement rates by up to 10x and boosted conversions across physical and digital channels, including retail branches and the mobile banking app.

Today, even in our digital channels, where we have 31 million active users, we're able to take the 150-plus big data attributes that we have at that moment, and in 350 milliseconds or less, come back with something that is targeted to you.

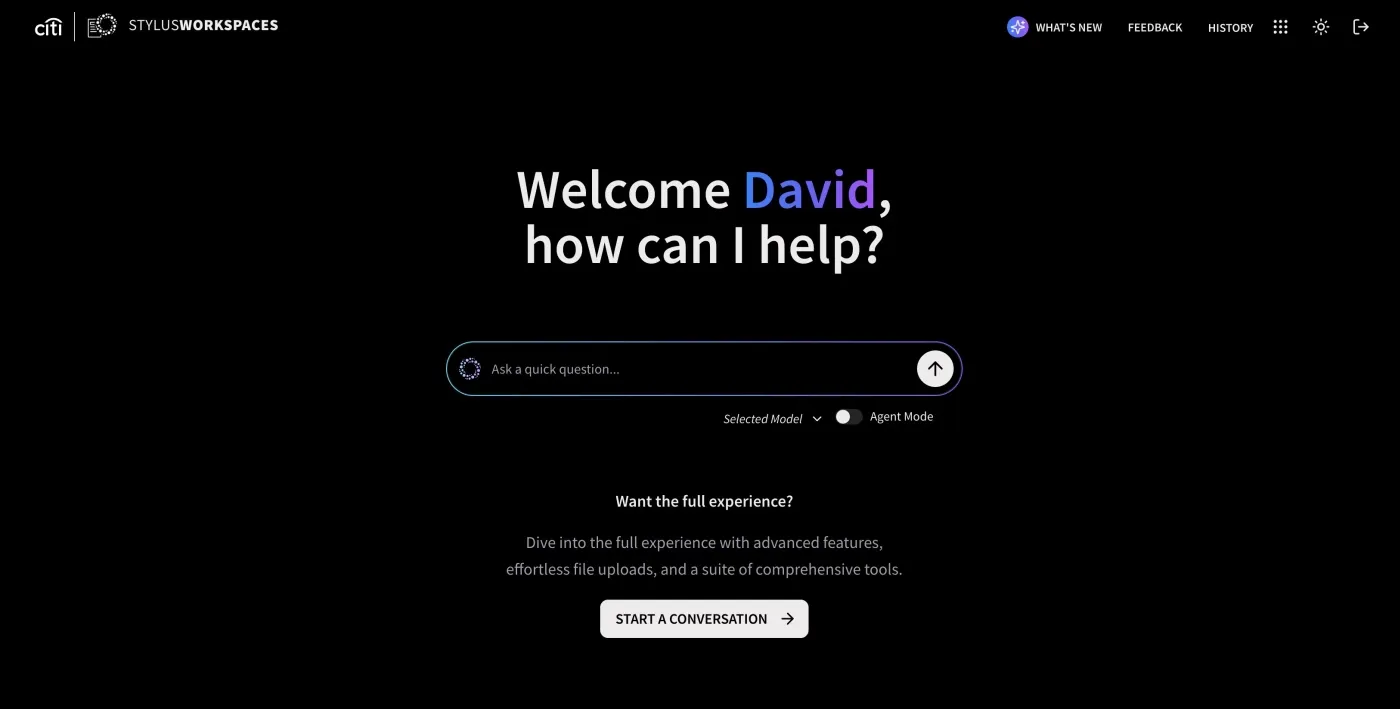

American investment bank Citigroup recently launched an agentic AI tool to assist its employees with their daily tasks, boosting their productivity and enabling them to focus on more strategic work. The GenAI-powered agent, which integrates seamlessly with Citi's project management software and other corporate systems, can draft emails, generate presentations and Q&A materials, and summarize documents based on user prompts. The organization also introduced dedicated training programs to help employees familiarize themselves with the new fintech solution and fully leverage its potential.

Image title: Citi’s Stylus Workspaces interface

Image source: WSJ

| The global AI in banking market size was estimated at $26.23 billion in 2024 and is expected to reach $379.41 billion by 2034. The service and solution segments accounted for 43% and 57% of the market, respectively | |

|---|---|

| 88% of banks and other firms in the financial services industry are already using AI/ML tools. 50% of respondents increased their investments in them by more than 25% from 2023 to 2024 | |

| The percentage of banks having actively launched or soft-launched GenAI applications has increased from 61% in 2023 to 77% in 2025 | |

| 70% of banking executives surveyed said their organization uses agentic AI to some extent, either through fully deployed solutions (16%) or pilot projects (52%) |

| In 2025, banks are using GenAI or AI for data-driven insights and personalization (85%), operational efficiency and automation (79%), security management and fraud prevention (78%), and regulatory compliance and risk prevention (71%) | |

|---|---|

| GenAI use case implementation spans across front-office functions like sales and customer service (43%), middle-office functions like risk management and compliance (34%), and back-office functions like IT support and accounting (23%) | |

| Over 42% of AI-implementing European banks have used generative AI for user support (for instance, chatbots), making it the leading GenAI use case |

Scheme title: Top use cases of predictive AI in banking and other financial services

Data source: IIF

| European banks that replaced statistical modeling approaches with machine learning experienced up to 10% increases in sales of new products, 20% savings in capital expenditures, and 20% declines in customer churn | |

|---|---|

| According to banking executives, agentic AI systems are highly capable of improving fraud detection (56% of leaders surveyed), enhancing security (51%), cutting cost and increasing efficiency (41%), and improving the customer experience | |

| Between 32% and 39% of the work performed across banks, insurance firms, and capital markets has high potential to be fully automated with AI | |

| GenAI adoption in the global banking industry can add between $200 billion and $340 billion in value (2.8% to 4.7% of total industry revenues) annually thanks to increased productivity | |

| 58% of banks expect a revenue increase of 6% to 20% from GenAI applications |

Scheme title: AI adoption benefits in banking

Data source: KPMG

| The main barriers to further progress in GenAI implementation include regulatory compliance challenges (26%), data privacy concerns (22%), and limited access to high-quality data (21%) |

|---|

Scheme title: Top AI/ML deployment challenges in banking and other financial services

Data source: IIF

Scheme title: Key challenges of using agentic AI in banking

Data source: MIT

ML technology provides data-driven insights to better approach and mitigate various types of financial risk in the banking sector, including credit and investment risk via ML-based predictive analytics or fraud and cyber risk through anomaly detection.

Based on analytical and predictive insights generated by ML-powered tools, banks can make better trading and investment decisions, as well as identify more effective strategies to engage customers and boost profitability.

Chatbots, AI agents, and other ML-powered solutions enable banks to streamline time-consuming operations, such as financial document processing and customer case management, increasing employees’ productivity while cutting operational costs.

Banking institutions can deploy robo-advisors and service chatbots to assist clients 24/7, or leverage ML-based analytics solutions to identify client needs and thus deliver personalized customer experiences, including tailored banking service recommendations.

Concerns | Recommendations | |

|---|---|---|

Data quality & availability |

AI-powered solutions require large amounts of data first for AI model training and then, when deployed to

the production environment, to perform properly. In many banking institutions however, this information is

outdated and scattered across multiple fragmented systems, unavailable to ML solutions.

|

|

ML model bias & black-box ML |

While advancements in machine learning techniques are making AI systems increasingly accurate, these

solutions still can suffer from bias. For instance, a credit scoring system can unfairly deny loans to

qualified applicants from lower-income minorities. Furthermore, these decisions are often inscrutable, as we

don't know exactly how an ML system comes to a certain conclusion.

|

|

Security & compliance |

The data-driven nature of machine learning systems can raise privacy and security concerns among both

customers and regulatory bodies, especially when it comes to highly sensitive banking data. As they handle

large amounts of confidential information, these solutions can also become an attractive target for

cybercriminals.

|

|

Team up with our machine learning specialists to develop high-performing software solutions with advanced automation and analytics capabilities tailored to your needs.

Rely on our team of consultants to plan and supervise your machine learning project, ensuring seamless software delivery and maximizing the impact of your digital transformation initiative.

Rising fraud and cybercrime, market volatility, and customer expectations for a more personalized experience are just some of the many challenges banks face every day. By enabling advanced analytics, forecasting, and automation capabilities, machine learning technology is already helping financial institutions address these challenges.

At the same time, adopting machine learning comes with its own issues, including stringent data requirements, potential lack of transparency, and compliance concerns. Team up with an experienced IT partner like Itransition to adopt a machine learning solution fully tailored to your business needs and maximize its value for your organization.

Insights

Explore key areas of application, real-life examples, trends, and benefits of AI in fintech, along with adoption challenges and strategies to address them.

Service

Itransition delivers a wide range of banking solutions to help banks automate business operations, improve client servicing, and ensure regulatory compliance.

Insights

Explore how financial data analytics software helps businesses assess their financial performance, mitigate risks, and increase profitability.

Case study

Learn how we developed a suite of investment portfolio management tools and custom algorithms now used by thousands of investors.

Insights

Explore the role of machine learning in stock market prediction, including use cases, implementation examples and guidelines, platforms, and the best algorithms.

Case study

Read how Itransition developed a platform for streamlining the entire range of back-office loan management operations.

Services

Industries