Services

SERVICES

SOLUTIONS

TECHNOLOGIES

Industries

Insights

TRENDING TOPICS

INDUSTRY-RELATED TOPICS

OUR EXPERTS

August 14, 2025

Insurance CRM systems typically include marketing functionality to help companies segment audiences based on their demographic data and behavior and launch targeted marketing campaigns. Marketers can also leverage the AI capabilities of CRM platforms to quickly generate promotional content, automate and adjust social media scheduling for maximum reach, and fine-tune budgeting.

Optimize ad spend and boost lead generation

Insurers can use CRM solutions to automatically capture lead information from web forms and other channels and rank leads with AI engines to focus their sales efforts on higher-value ones. Furthermore, insurers can create more personalized communications and offers for new leads, including insurance products with coverage options matching their preferences.

Foster lead acquisition, nurturing, and conversion to accelerate sales pipeline

A CRM solution enables agents to centralize customer information, such as personal data (name, address, telephone number, email, etc.), communication history, contact information, and respective policies and claims. Insurance agents can also easily search for this information in the CRM system to get more context when working on a deal or assisting customers.

Facilitate customer engagement and provide more relevant support

CRM software helps insurance companies create, assign, and track daily sales activities. It can also automate clerical tasks like scheduling appointments, sending follow-up emails, and generating personalized proposals, quotes, and invoices. Additionally, CRM enables sales teams to track multichannel communications with prospects and customers through a unified solution and monitor their sales pipeline progress via visual dashboards.

Improve sales team coordination and productivity to consistently drive sales

Insurance-oriented CRM solutions feature automation capabilities to streamline policy management, including policy issuance, billing, premium scheduling and collection, renewal, endorsement, and commission calculation. Furthermore, agents can use CRM software to create catalogs of insurance products and establish their respective coverage terms and eligibility rules, or leverage CRM’s collaboration tools to share and discuss policy details.

Reduce administrative workloads and minimize the risk of сostly manual errors

With the help of CRM, insurance agencies can automatically distribute incoming claims to available agents. In addition, CRM solutions can extract data from FNOL and other documents, verify coverage based on predefined rules, calculate the due claim payment amount according to available information, and proceed with claims settlement through full or recurring payments. Some CRM platforms also enable insurers to create self-service portals that clients can use to submit claims and track their status.

Speed up claims processing to improve customer satisfaction and retention

Modern CRM platforms for insurers generally provide advanced data analytics and reporting capabilities powered by artificial intelligence to monitor customer behavior, forecast sales and revenues, and track relevant KPIs, such as sales per policy type and distribution channel or monthly policy renewals.

Optimize your CRM strategies and make more informed business decisions

Companies can integrate their insurance CRM software with other corporate applications or third-party services to facilitate data exchange and consolidation and harmonize their business processes:

to coordinate CRM operations with other key corporate functions, such as finance and accounting and human resources management

to personalize policies based on policyholders’ demographic data, risk profiles, or other details stored in the CRM system and automatically populate policy issuance and renewal documents with CRM data

to initiate claims intake with CRM software and transfer customer and policy information to the claims management system for further processing or send real-time claims status updates to service agents and clients through the CRM platform

to help agents create accurate risk profiles and determine eligibility, coverage terms, and premiums based on client information from the CRM system, such as age, occupation, income, and credit score

to provide clients, agents, and brokers with self-service access to policy details, application statuses, payment history, claims updates, and other relevant information from the CRM

to target leads and customers with marketing messages based on CRM data and record leads captured with the marketing tool into the CRM system for faster sales follow-up

to populate insurance contracts, claim forms, and other documentation with customer data from the CRM and add these documents to respective customer records in the CRM for faster retrieval

to create personalized quotes and proposals for insurance products, calculating prices and applying discounts based on CRM data like customers’ demographics, financial information, and behavior

to fill in quotes, invoices, and other financial documents with client data from CRM software and streamline credit and collections management by directly accessing customer payment history

to communicate with clients and partners directly from your CRM software and record all interactions for a more comprehensive view of each contact

to enrich customer records with information gathered from credit reporting agencies, motor vehicle records, or other sources, and thus facilitate KYC and underwriting processes

While the modern CRM solutions market is rather mature, only a few platforms can boast insurance-specific functionality and a strong market presence together with high user satisfaction. Here's a brief selection of popular CRM solutions featuring out-of-the-box insurance-oriented capabilities.

Salesforce is an undisputed CRM market leader that offers an impressive range of generic products for sales and marketing and Financial Services Cloud, a comprehensive CRM solution geared towards the unique needs of insurers and other BFSI companies. Furthermore, insurance companies can choose from the four bundles tailored to specific insurance sectors (Agencies & Brokerages, Life & Annuity, Group Benefits, and Property & Casualty) that combine Financial Services Cloud with other Salesforce products.

Insurance firms of any size that require an advanced CRM solution with off-the-shelf, industry-specific capabilities for faster implementation

Steep learning curve and expensive modular licensing

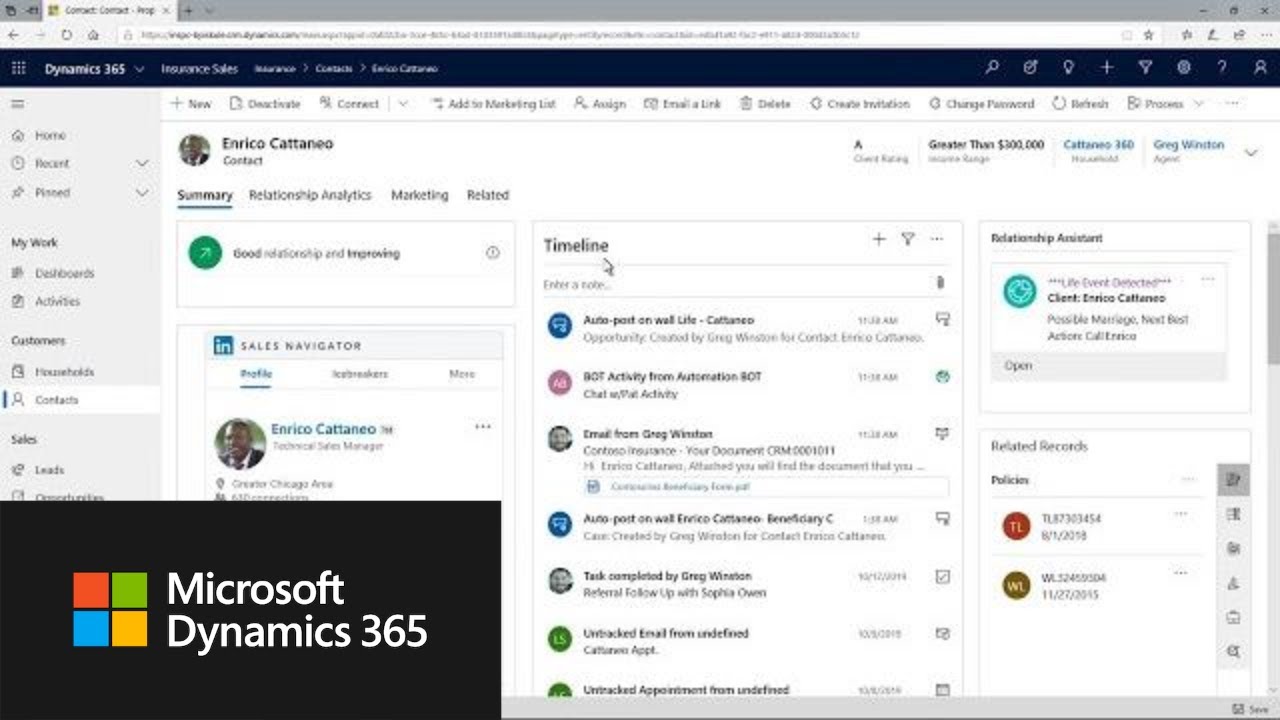

Dynamics 365 is an extensive suite of business applications that offer advanced CRM and ERP capabilities to meet your customer needs and includes AI-based sales and service automation and analytics.

SMBs and enterprises that already rely on the Microsoft ecosystem or need a highly customizable CRM solution

Complex administration and limited off-the-shelf integrations with third-party services

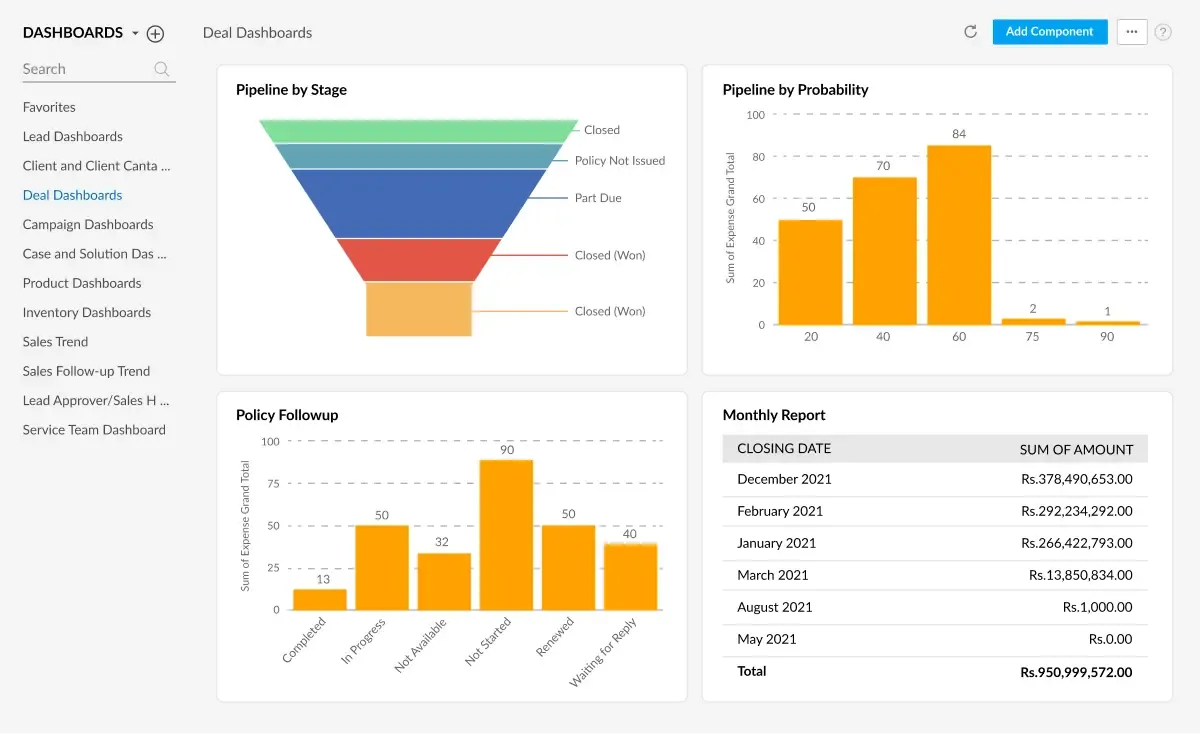

Zoho is a highly flexible software solution with a fully customizable user interface and over 500 out-of-the-box integrations. The platform provides insurers with general-use CRM capabilities and specialized tools for policy administration and claim resolution.

Image title: An example of Zoho’s analytical dashboard

Image source: zoho.com —

Best CRM Software for Insurance Agents

Medium-sized insurance companies or small businesses looking for affordable and user-friendly CRM software

Integration complexities and poor support according to some users

LeadSquared is an intuitive software solution that combines generic CRM features for marketing automation and sales execution with a rich set of insurance-oriented capabilities to boost policy sales and renewals.

Midsize organizations searching for a CRM solution with robust lead management capabilities

Sporadic lags, downtimes, bugs, and glitches

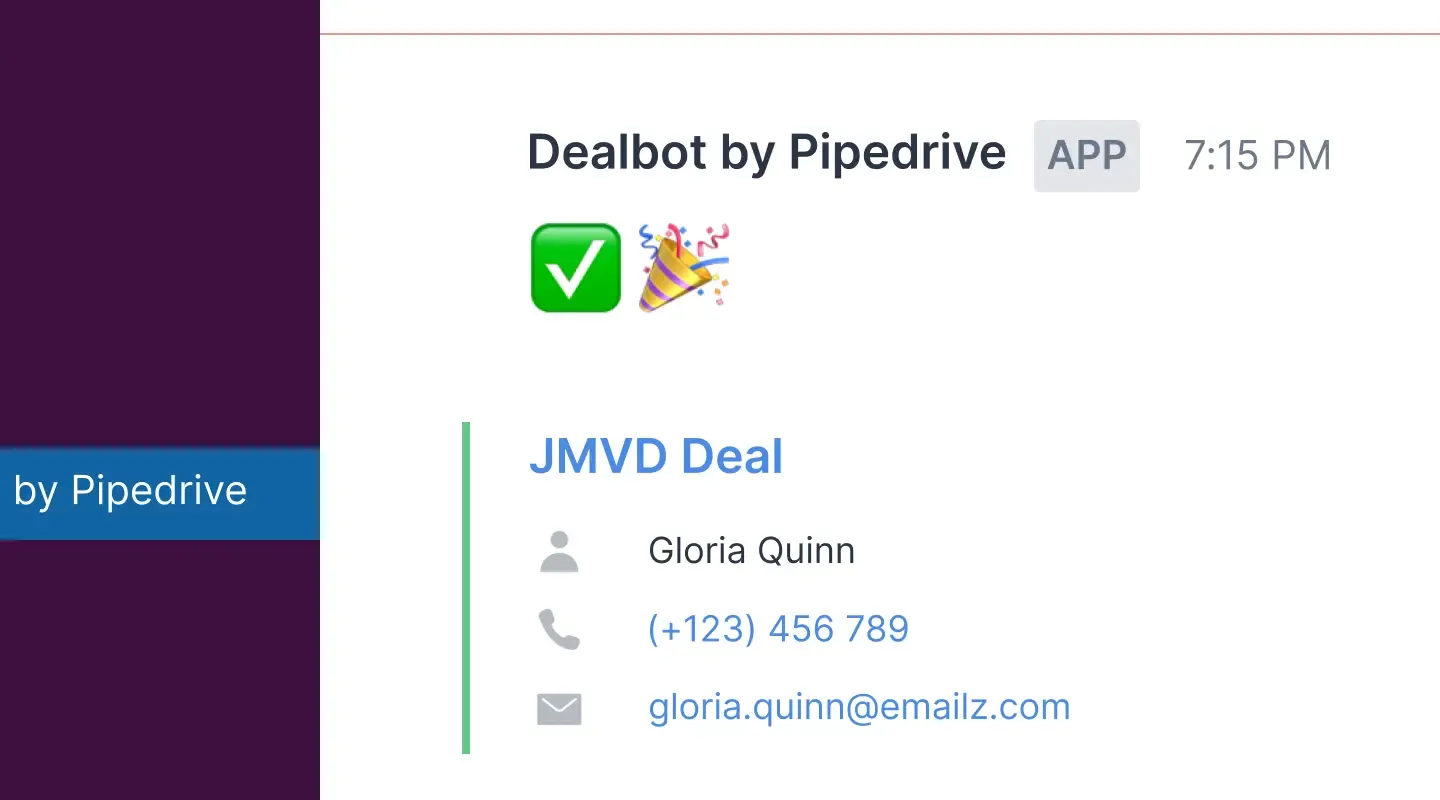

Pipedrive is a user-friendly sales CRM that focuses primarily on lead management and sales automation but complements these industry-agnostic capabilities with specialized functionality for insurance policy and claims management.

Image title: Pipedrive’s automated Slack notifications

Image source: pipedrive.com — Workflow automation

Sales-oriented insurance agencies that prioritize usability over advanced functionality

Lack of advanced marketing and analytics features

Shortlist CRM platforms with out-of-the-box features, including insurance-oriented ones, that are close to your ideal functional scope, as well as built-in integrations with other systems or services you currently use. Top platforms also provide low-code/no-code customization and integration tools to further align their built-in capabilities with your needs. Ease of use on mobile devices and possibly the availability of a dedicated app is another aspect worth considering.

Request detailed quotes from CRM vendors and compare their pricing models (per-user, tiered by features, etc.) and managed services included in the license (such as support and updates) to identify the most convenient option. You need to pay attention to contract clauses that can impose vendor lock-ins which can prevent you from switching to another CRM, or entail unexpected costs for premium services.

Ask business partners who have already adopted the CRM platform you’re interested in if they’re satisfied with it. You can also consult peer-to-peer review sites like G2 or Capterra to identify the most popular products by user base and score and get an idea of each platform’s pros and cons.

Several CRM platforms currently offer free trial periods, allowing your organization to test them before adoption. Get the most out of this opportunity by establishing a trial team of members from departments like marketing, sales, or customer service to gather comprehensive feedback.

By implementing CRM systems, businesses can centralize sales and customer data, policy details, and other key information from multiple corporate systems or communication channels into a single platform. This allows insurance companies to identify upselling and cross-selling opportunities, optimize their service offering, and harmonize their business processes.

CRM software can automate time-consuming clerical tasks like policy administration and claims management while enabling insurance agents to focus on strengthening client relationships.

CRM solutions enable insurers to maximize lead generation through segmentation, targeted marketing campaigns (including email marketing), and omnichannel engagement. Insurance companies can also boost conversion rates via lead ranking, sales force automation, and personalized offers.

Insurance firms can leverage CRM software to boost customer satisfaction through tailored insurance plans that meet their expectations as well as faster claims processing and settlement. This typically results in long-term loyalty and higher lifetime value.

Itransition helps insurance companies build and adopt custom CRM software or platform-based solutions in line with their specific needs.

Despite being a general trend across the entire industry spectrum, a more customer-centric approach can be particularly beneficial for the insurance sector. Agents interact daily with clients who are facing or preparing for delicate situations and, for this reason, may be in distress and require special attention.

CRM systems help insurance professionals address such needs, enabling more personalized and responsive service delivery. Consider partnering with Itransition to implement a CRM solution meeting your corporate goals and the expectations of your customer base.

Thanks to its data consolidation and process automation capabilities, CRM software can help insurance companies fully meet their audience's service expectations, build long-term customer loyalty, and stand out from the competition. In fact, CRM systems enable insurance companies to gain a 360-degree view of each customer and offer more personalized services, such as tailored coverage options. Furthermore, these tools allow companies to automate time-consuming processes such as data entry for claims processing and thus facilitate faster customer support in times of need, whether it's a car accident or a medical emergency.

While both customer relationship management (CRM) software and agency management systems (AMS) are key components in insurance companies' digital toolkits, they serve distinct primary purposes.

That said, their operational scope can partially overlap, especially in insurance-specific CRM solutions.

The scope of a general-use CRM platform usually encompasses the three main customer-related functions of most businesses, namely marketing, sales, and customer service. These capabilities can be expanded through customization to best meet an insurance company's needs, but the process may be costly or limited within predefined settings established by the vendor.

A CRM solution for insurance agents and firms, on the other hand, complements this generic functionality with out-of-the-box capabilities typically found in more specialized solutions like agency management systems. For instance, users can set up automated workflows for claims management and policy administration. Some platforms, such as Salesforce, even differentiate their offerings based on specific insurance segments, including life insurance and property insurance.

Service

Itransition delivers insurance portals to help agents and brokers streamline insurance workflows, gain valuable insights, and drive customer retention.

Case study

Learn how Itransition’s customized Salesforce CRM has brought a US insurance buyout agency 54% more leads.

Service

We provide insurance software development services to help companies streamline insurance workflows and improve their efficiency and customer servicing.

Service

Itransition delivers tailored reinsurance management software to help firms automate reinsurance workflows, support decision-making, and increase profitability.

Insights

Discover distinctive elements, key features, and benefits of enterprise CRM software, along with top platforms and criteria for choosing the most suitable one.

Insights

Hire a certified Salesforce services provider with 10-year expertise in Salesforce CRM and other solutions to carry out seamless adoption and transformation.

Platforms

Industries

Insights