Billing management software for a US tax payment service provider

Itransition redesigned the architecture of the customer’s online billing management system, improving its performance, security and extending it with new features.

Table of contents

Context

Our customer is a US-based company specialized in accounting and tax management solutions. The company collaborates with top accounting firms and serves many recognized brands, including Sony, Netflix, and BMW, with the mission to simplify essential financial operations.

To carry out this mission, the customer introduced online billing management software to help companies automate and optimize their accounting processes. The solution is a SaaS application based on .NET and providing tools to control transactions and keep track of accurate data on organizations’ cash flows and financial liabilities.

Unfortunately, over time the application got outdated and couldn’t provide the scalability and flexibility required by numerous businesses using the service. What’s more, it was critical to integrate the application with popular accounting systems, make the solution available in any location, and improve its security level.

To hit the outlined goals, the customer decided to partner with an experienced IT outsourcing provider who could uplift the application’s functionality, as well as suggest and implement performance and security improvements. The customer turned to Itransition based on our experience in finance software development and our profound knowledge of the financial domain.

Solution

During the first stage of the project, Itransition’s team analyzed the solution’s legacy code and general logic and suggested feasible improvements. Since the application was based on Microsoft Access, we proposed migrating it to a newer platform with a preliminary architecture redesign.

Architecture reengineering and cloud migration

The team suggested migrating the outdated solution to a new architecture based on the modern Microsoft Azure stack.

Our key objective was to minimize the number of components deployed and maintained on-premises. We only retained such on-premises components as scanners, OCR, and check printers as they depended on the physical infrastructure. We redeployed all other components, including the complete UI, to the cloud.

Other project goals we met included:

- Business process automation aimed at reducing manual work, increasing workflow management speed, and minimizing the risk of errors.

- Application availability throughout all geographies.

- Flawless processing of numerous bills.

- The application’s simplified support and maintenance.

Itransition’s team rewrote the database structure completely, moving most of the solution components to Microsoft Azure. Considering Azure’s globally distributed network of data centers, it was the right technology to make the solution location-independent.

The migration also contributed to the solution’s greater scalability and storing capacity. The application became more stable and capable of performing without downtimes even at peak loads, as well as of restoring automatically in case of failures.

Adopting the new architecture allowed the team to rework the app’s user interface and ensure its consistency across the most popular web browsers, including Google Chrome, Safari, Internet Explorer, Microsoft Edge, and Mozilla Firefox.

The new architecture also brought vital improvements to the solution’s security and allowed:

- Centralizing user identity management

- Protecting the app from malicious input attacks

- Improving resilience to common types of attacks such as SQL injection, XSS, and XSRF

- Making the app compliant with the PCI DSS standard

- Securing access to the web services

Additionally, we implemented the following features:

- SAML SSO authentication

- TOTP two-factor authentication

- Access restriction by IP address

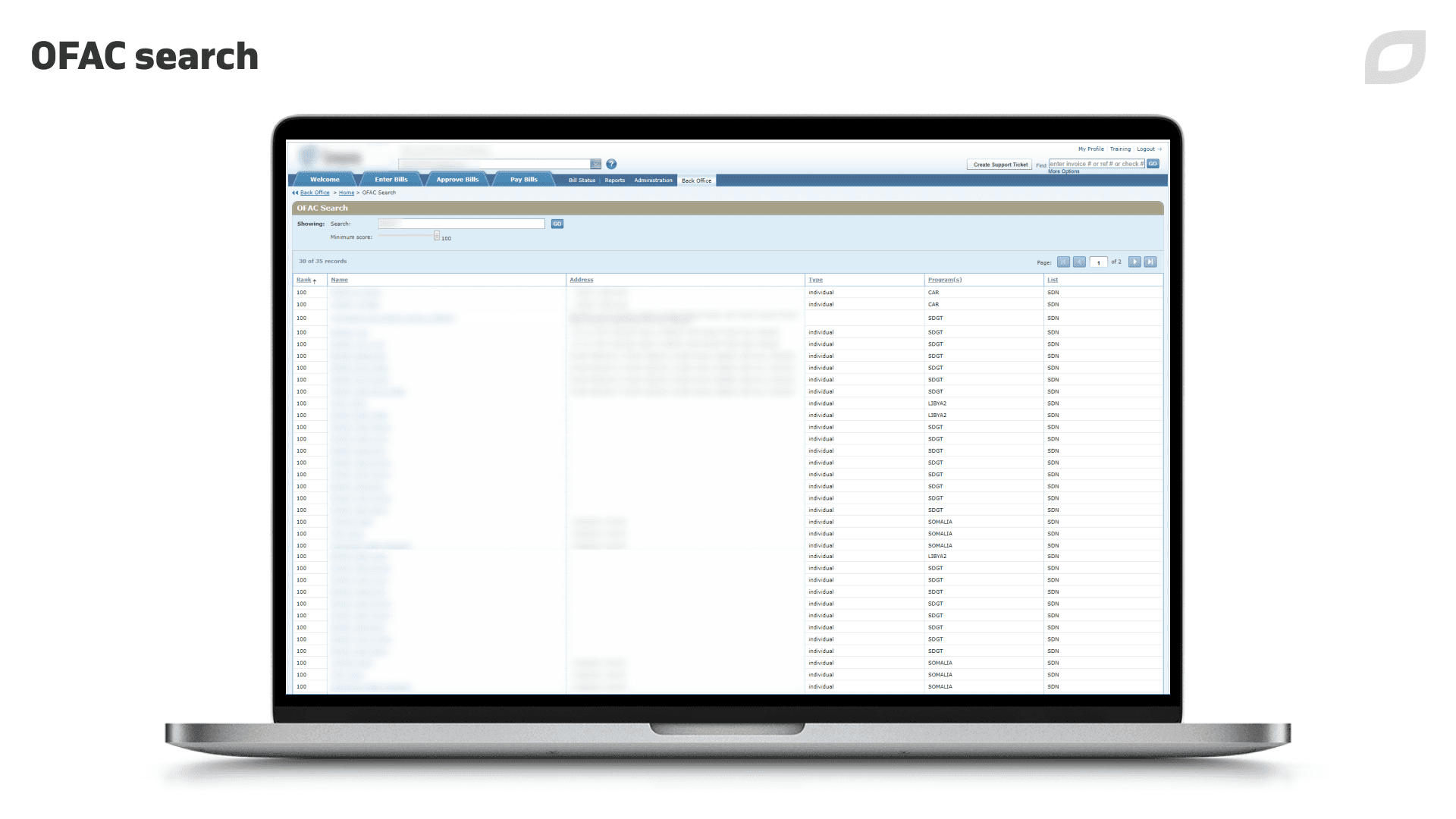

Itransition also ensured the solution’s compliance with the Office of Foreign Assets Control (OFAC) requirements and Know Your Customer (KYC) best practices.

At the next stage of the project, Itransition’s team migrated several subsystems to Microsoft Azure:

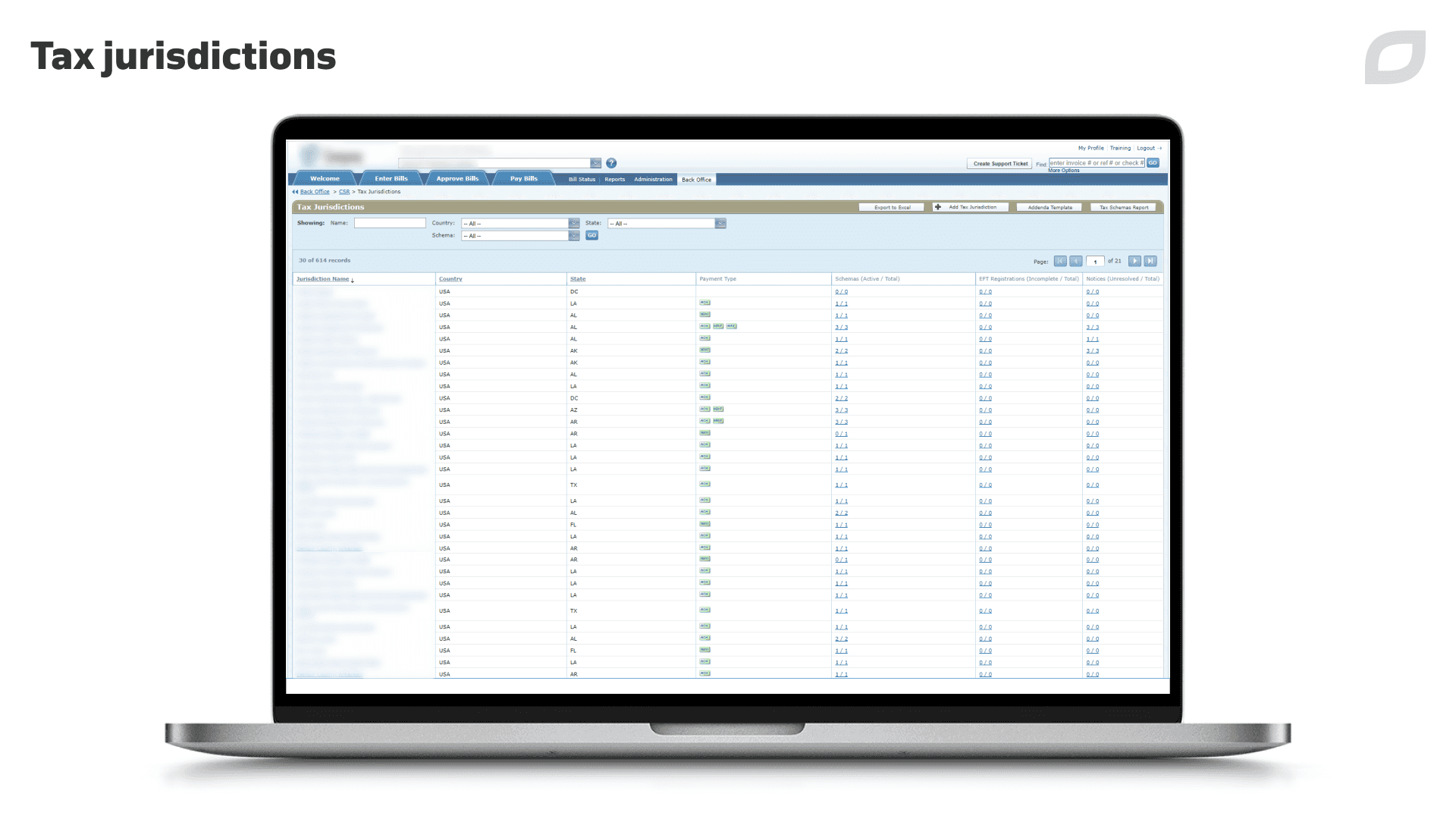

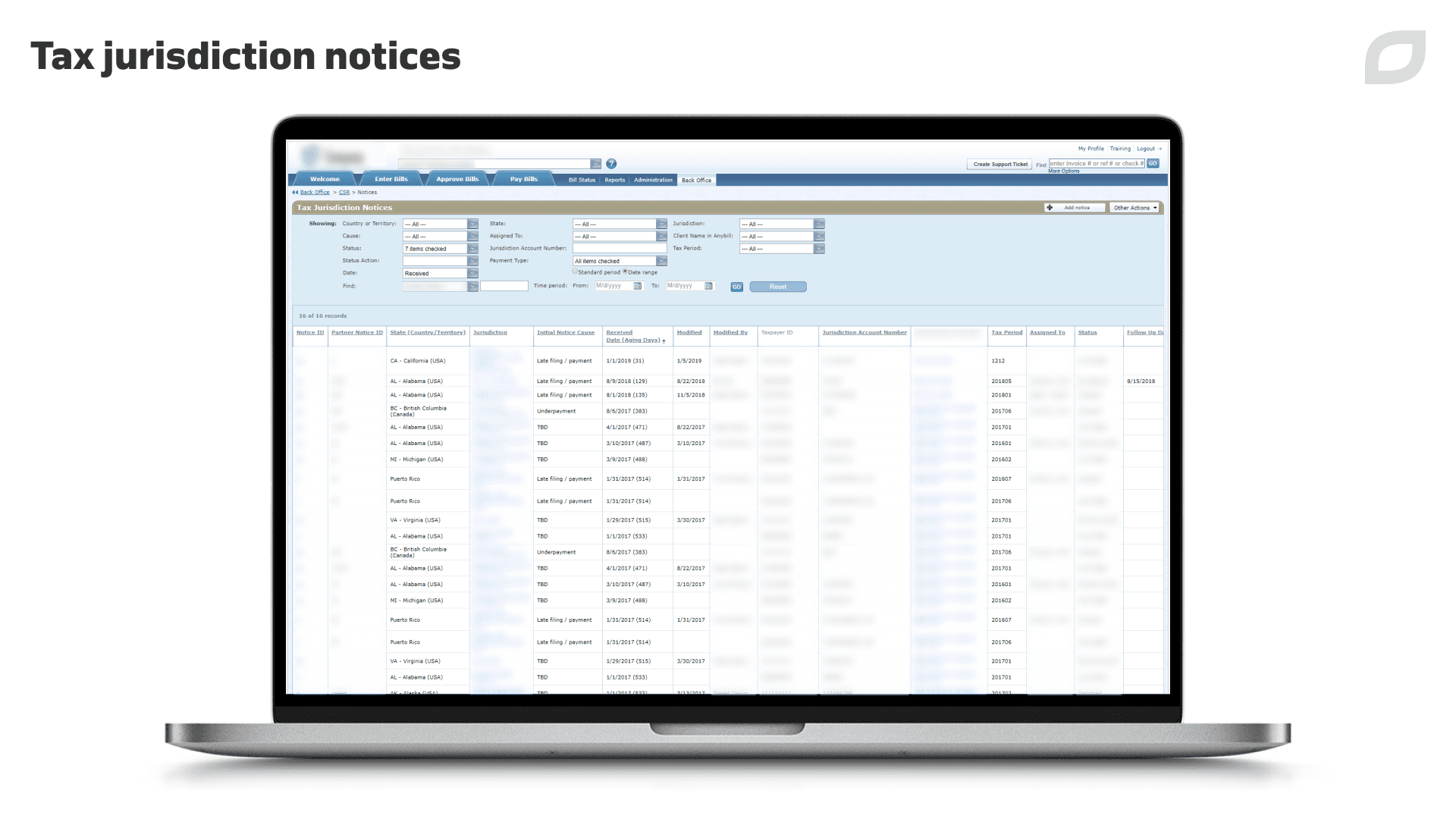

- The jurisdiction management system (JMS) for tax jurisdiction management, including automated and manual tax payment, management of tax notices, electronic funds transfer, as well as export of ACH Cash Concentration or Disbursement (CCD) files.

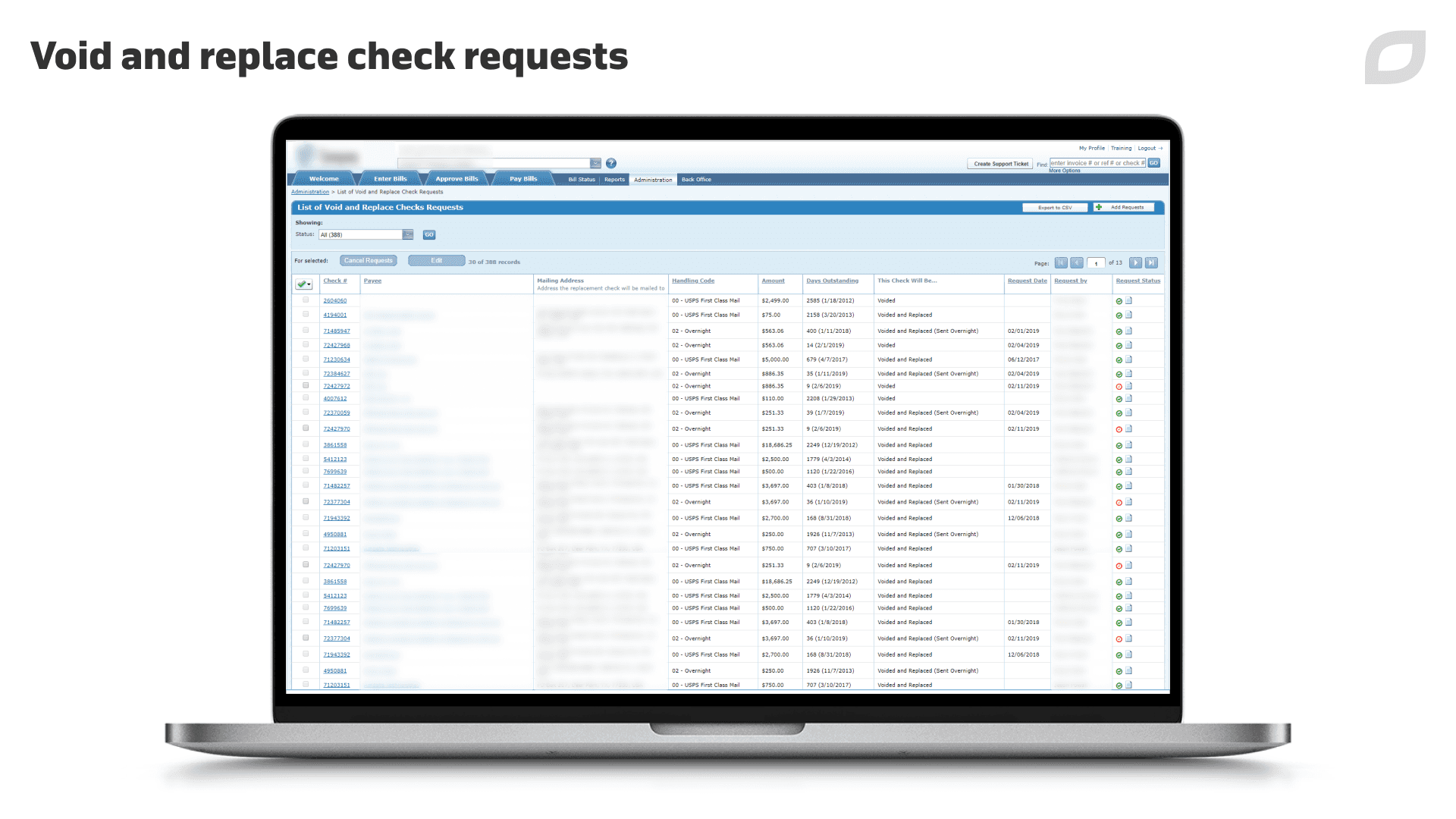

- The void & replace system for voiding and reversing electronic and paper check payments.

- Electronic voucher uploads for importing automatic accounts payable along with tax metadata.

- Billing for invoice generation and metadata management.

After the successful migration of the billing management software, its performance increased substantially, as seen in these important response metrics:

- The average response time: ≤1s

- Generating a report: ≤5s

- Preparing a batch of data for export: ≤10s

- Importing a bill into the system: ≤5s

Functional upgrade

Itransition successfully implemented the requested custom features and enriched the solution with the following capabilities:

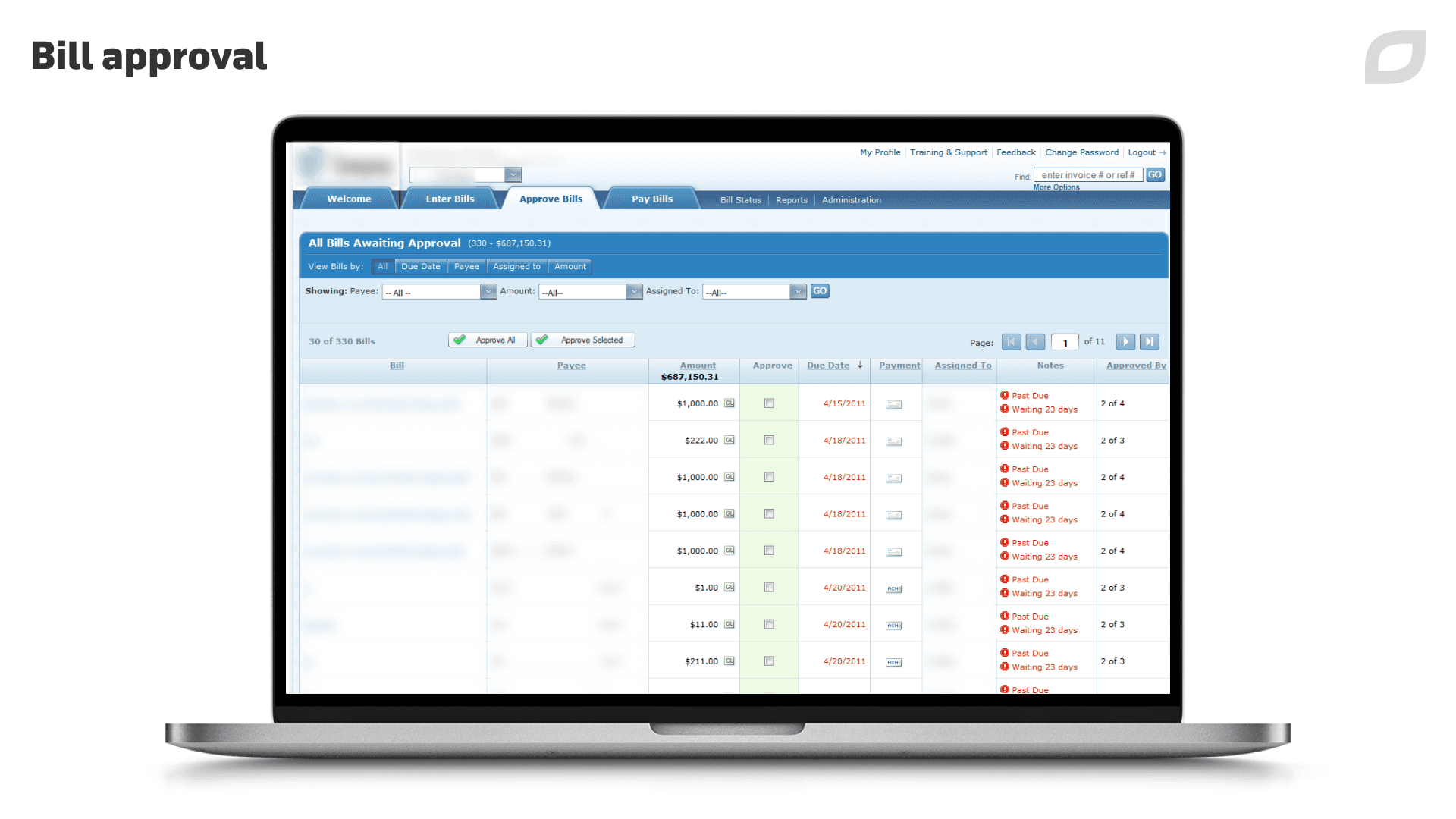

- Invoice distribution via customizable approval workflows

- Electronic signature

- Batch processing of approved invoices

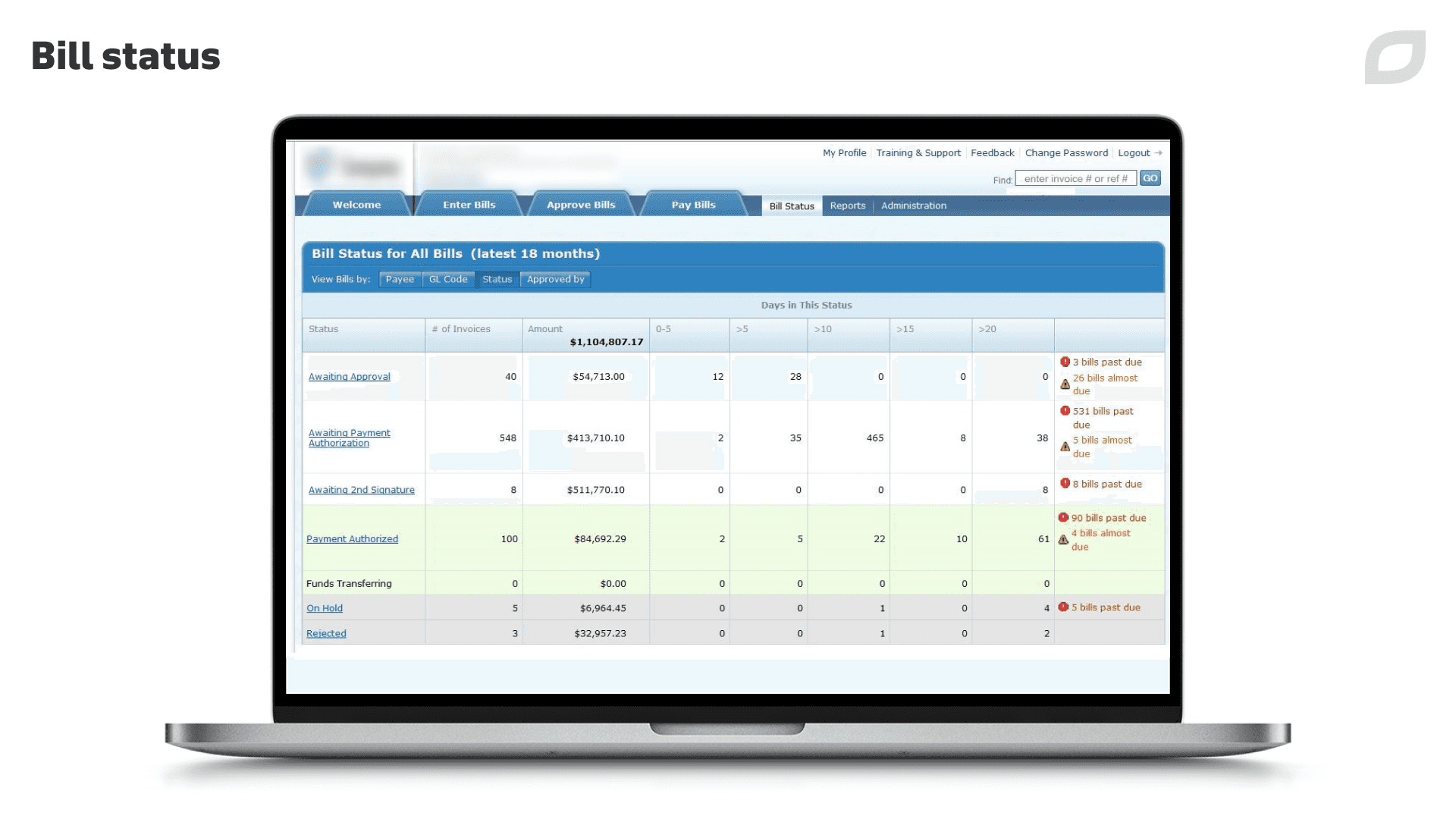

- Reporting accessible to end clients and operational staff

- Access to the vendor portal for payees for tracking approval and payment progress

- Configuration and automation of the approval workflow

Along with automating invoice distribution, we also enabled conditional rules and bill reassignment, as well as added extra payment thresholds to address payment needs of all subscribers.

Itransition’s team integrated the billing management software with several popular accounting applications, such as QuickBooks, QuickBooks Online, NetSuite, Sage Intacct, and Microsoft Dynamics GP, with the latter being the most frequently used accounting system among the customer’s clients.

Technologies & tools

We used Microsoft .NET and the ASP.NET MVC model to build the cloud-based application.

To enable static typing on the client-side, we developed the presentation layer with AngularJS as the client-side framework and the Kendo UI user control library written in TypeScript.

We opted for LESS CSS combined with the Bootstrap framework to simplify the development of responsive client-side layouts.

We chose Azure Cache for Redis and Entity Framework for the data access layer.

We used ASP.NET Web API to implement the server-side API endpoints for the client-side application. Windows Workflow Foundation (WF) workflows hosted on Quartz.NET were leveraged to implement long-running multi-step business processes.

The ActiveReports library was selected to support in-browser and PDF reports.

We followed the Inversion of Control (IoC) design principle and used the Autofac library to reinforce decoupling and simplify unit testing.

MSBuild, Jenkins, and Rake facilitated the build process and ensured that each version of the application was available for testing in time. Itransition’s testing engineers leveraged Selenium for test automation.

Our developers, testers and analysts collaborated in line with the Acceptance Test-Driven Development (ATDD) and Behavior Driven Development (BDD) practices, which were the integral parts of CI/CD.

Results

As we migrated the solution to a new architecture and upgraded its technological stack, we helped significantly expand the application’s capabilities, enhance its security, and facilitate its maintenance. Migration was also a necessary step to ensure the solution’s availability across different geographies.

The solution can now store millions of bill records and terabytes of images, support up to 500 concurrent user sessions, and handle up to 300,000 incoming bills per month.

The delivered billing management software helped the customer keep up with the increasing demands of businesses around the globe. Integration with the most widely used accounting systems and implemented security updates became the key value propositions for new clients. As a result, the customer’s client base expanded to over 1,500 companies, including 100+ Fortune 500 clients and 50+ accounting firms.

Satisfied with the project results, the customer shared their plans to develop the mobile version of the platform in cooperation with Itransition.

Insights

Application migration: a comprehensive process overview

Explore the strategies and best practices for application migration to help companies improve operational efficiency and reduce IT infrastructure costs.

Insights

Application integration: approaches & key concepts

Explore the methods and mechanisms of connecting disparate software systems to help companies achieve better operational efficiency and employee productivity.

Insights

Predictive analytics in finance: use cases, platforms & adoption guidelines

Explore predictive analytics use cases, real-life examples, and models for the financial sector, along with top platforms and implementation best practices.

Case study

Banking portal development for a large EU bank

See how Itransition handled banking portal development, redesigning an outdated internet banking app.

Case study

Salesforce CRM for a US insurance buyout agency

Learn how Itransition’s customized Salesforce CRM has brought a US insurance buyout agency 54% more leads.

Case study

Payment processing system redevelopment

Itransition's team revamped a payment processing system for an established payment transaction service provider.