SAP Commerce Cloud integration for Mydeposits

Helping Mydeposits grow their customer base by 25% with a unified SAP Commerce-based tenant deposit management and protection solution.

Table of contents

Context

Our customer, Tenancy Deposit Solutions Ltd. (trading as Mydeposits), is a government-approved provider of tenancy deposit protection in the UK. The company supports landlords and agents in complying with the legislation and securing deposits during the entire period of tenancy for all the parties involved. The customer has protected over £1.5bn worth of deposits and has dealt with more than 20k disputes on behalf of 150k landlords and letting agents.

The customer owned several disparate systems, developed by different teams since the company was founded in 2007. The systems did not match coding standards and suffered multiple legacy issues. Besides, collaboration between the customer’s multiple software engineering and maintenance teams were not transparent.

Therefore, the customer was looking for a reliable technological partner to solve these technical and process bottlenecks. As they had already been working with Itransition’s QA team and enjoyed our approach to setting up collaboration and communication practices, they readily turned to us for this major digital transformation.

Solution

In the beginning of the project, Itransition’s dedicated team analyzed the base code to identify such issues as no proper isolation of the application layers and code duplication, which we fixed by moving the business logic to the business layer and de-duplicating code respectively.

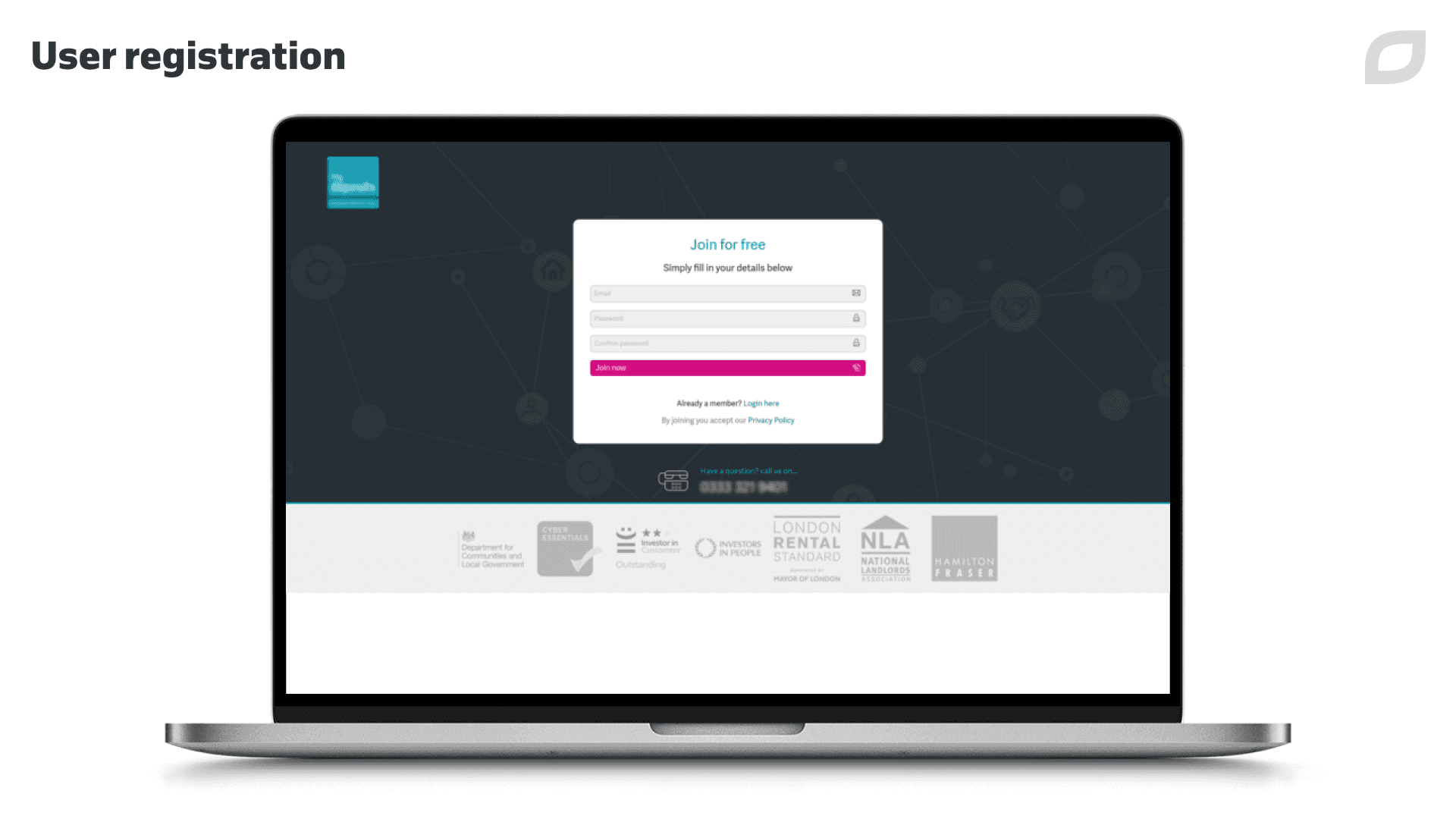

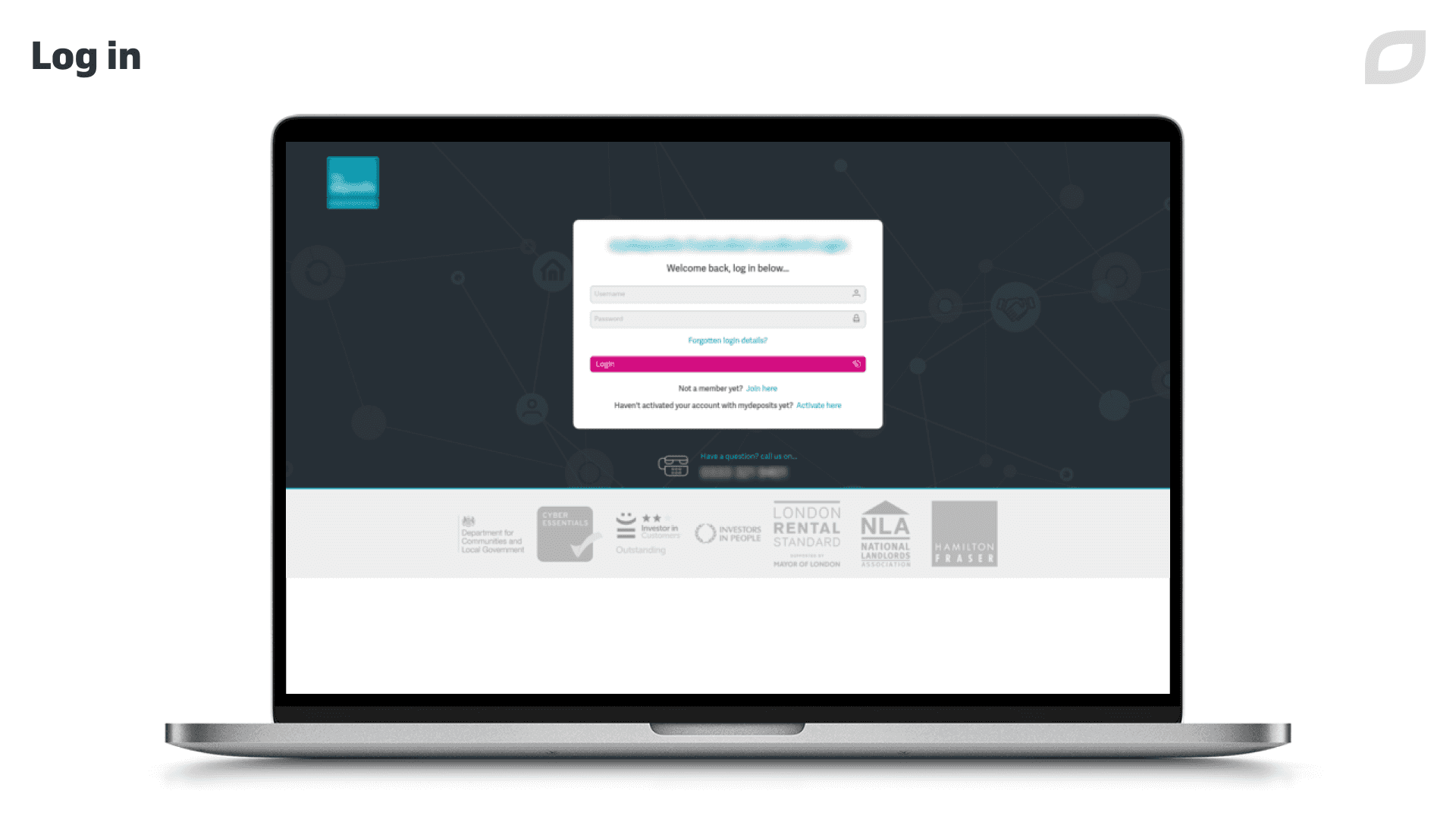

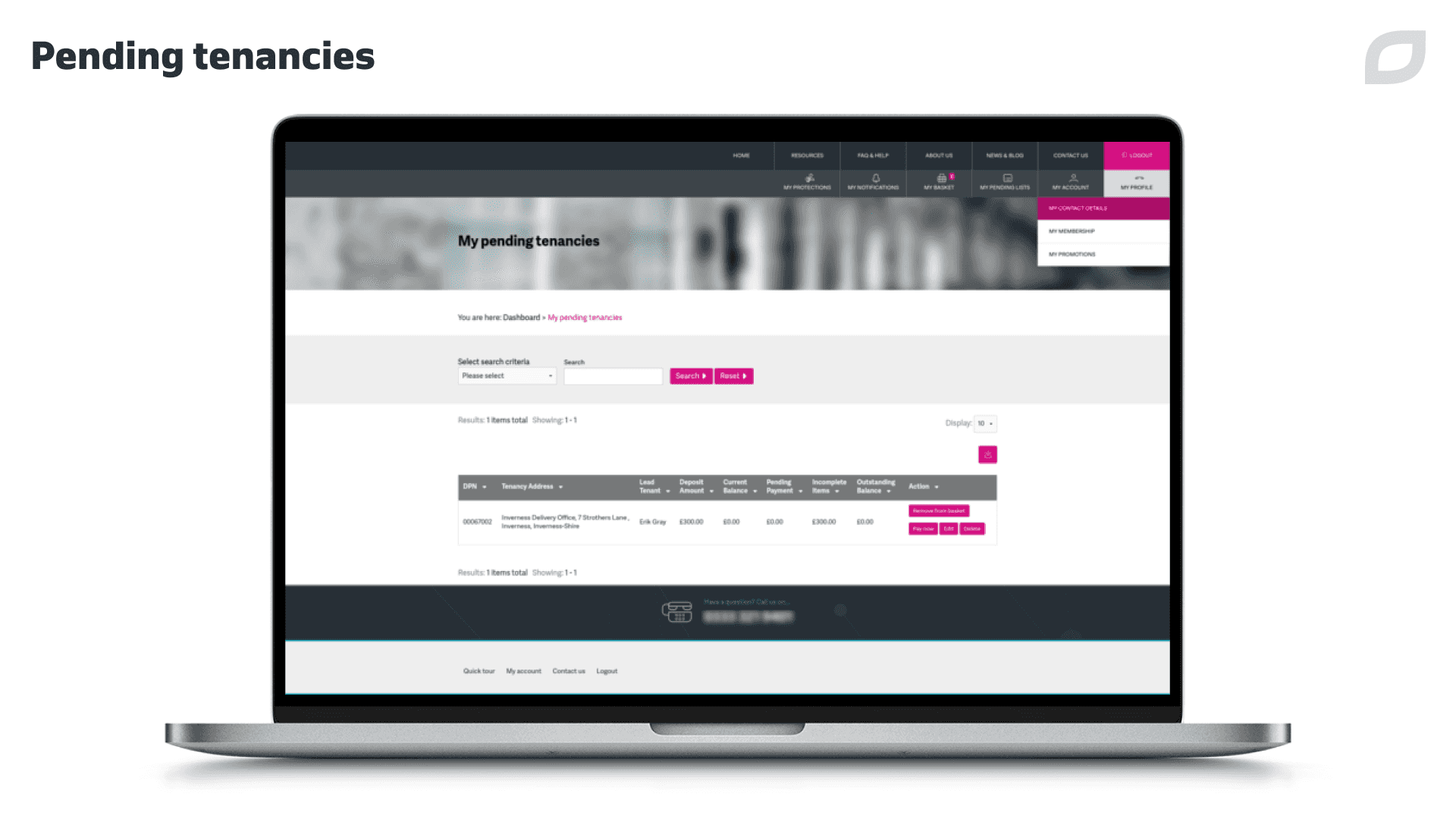

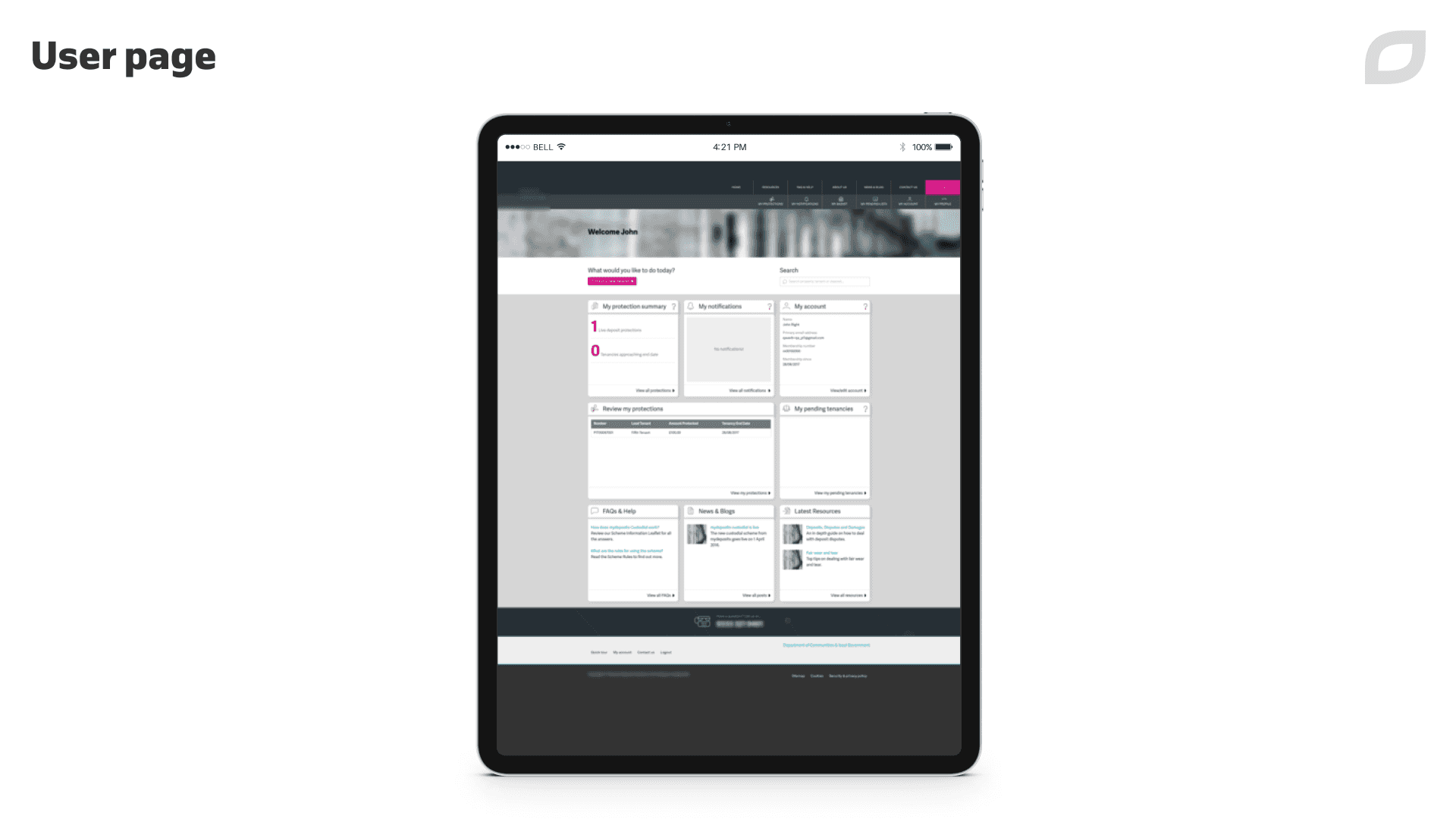

To integrate the customer’s existing systems, we developed a unified tenancy deposit solution with a coherent integrated environment that automated the retail part of the business. This solution comes with an interface for managing guaranteed deposits and disputes resolution. Its highly specific business logic is efficient at processing diverse aspects of creating and protecting tenants’ deposits.

The solution automates the following business processes:

- Leased property management

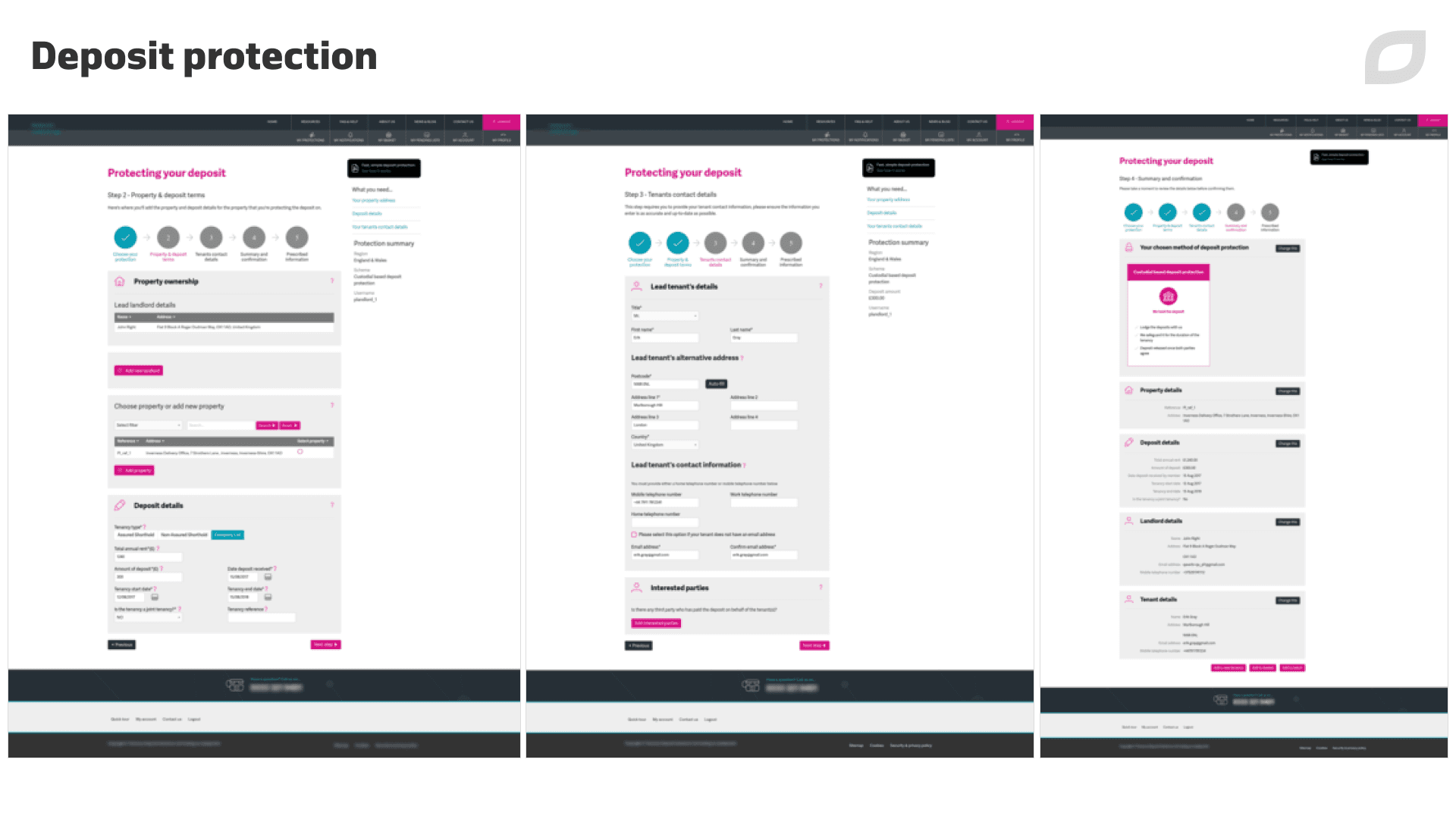

- Creation and editing of guaranteed deposits

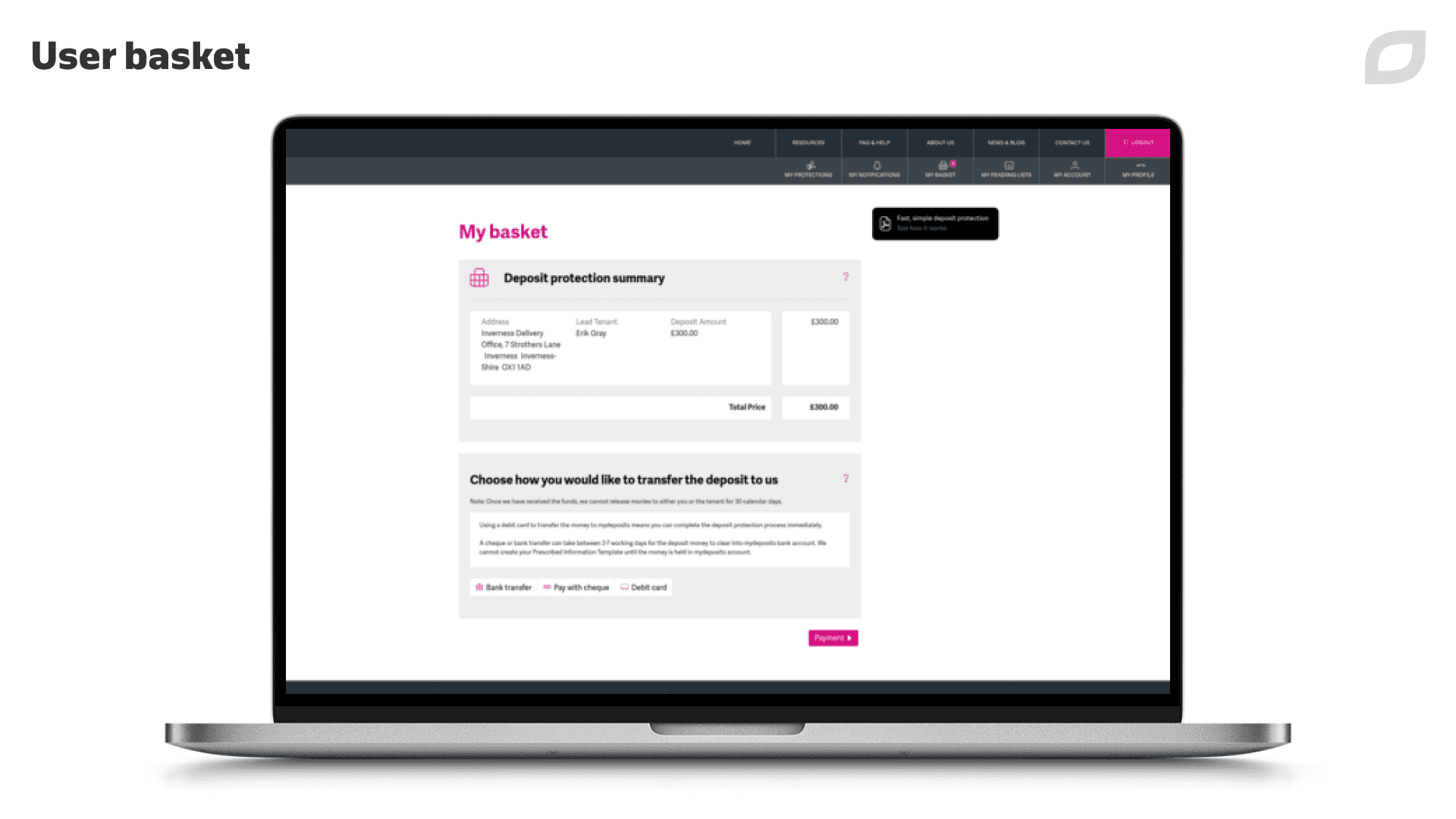

- Protection of guaranteed deposits (transferring funds from various sources: banks, credit/debit cards, cash, etc.)

- Management and resolution of disputes

When developing the solution’s functional modules, we relied heavily on our expertise in SAP Commerce consulting as this platform became the foundation for:

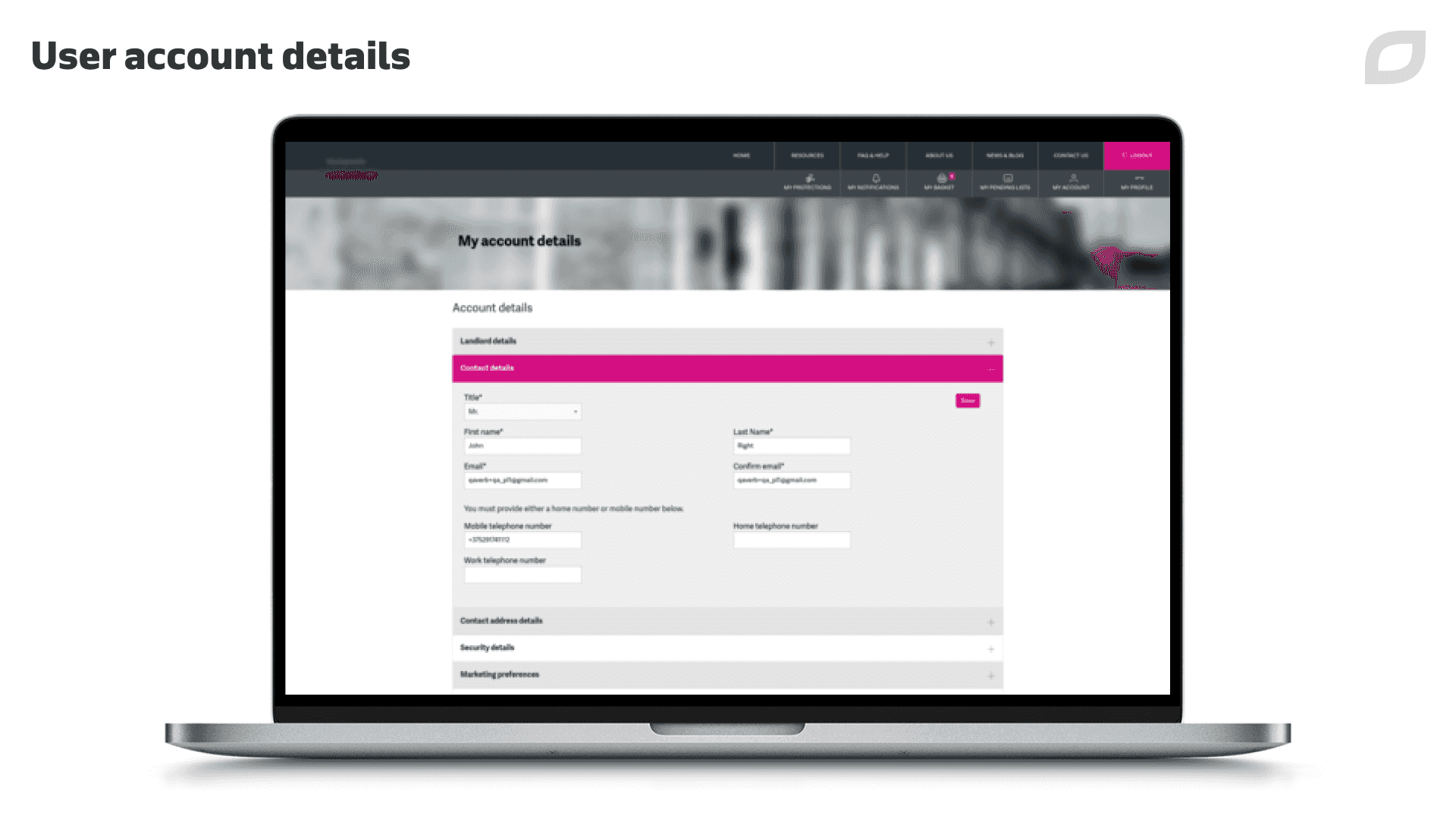

- The administrative module, allowing users to manage companies, units, user roles, and properties.

- The deposit module, allowing users to create and protect deposits.

- The disputes module, allowing landlords and tenants to exchange information within the framework of the initiated dispute.

The only module developed outside of SAP Commerce was the financial module, processing financial transactions and accounting statements, which was based on SAP Business ByDesign. Integrated with the deposit module, it enabled transferring funds to user accounts.

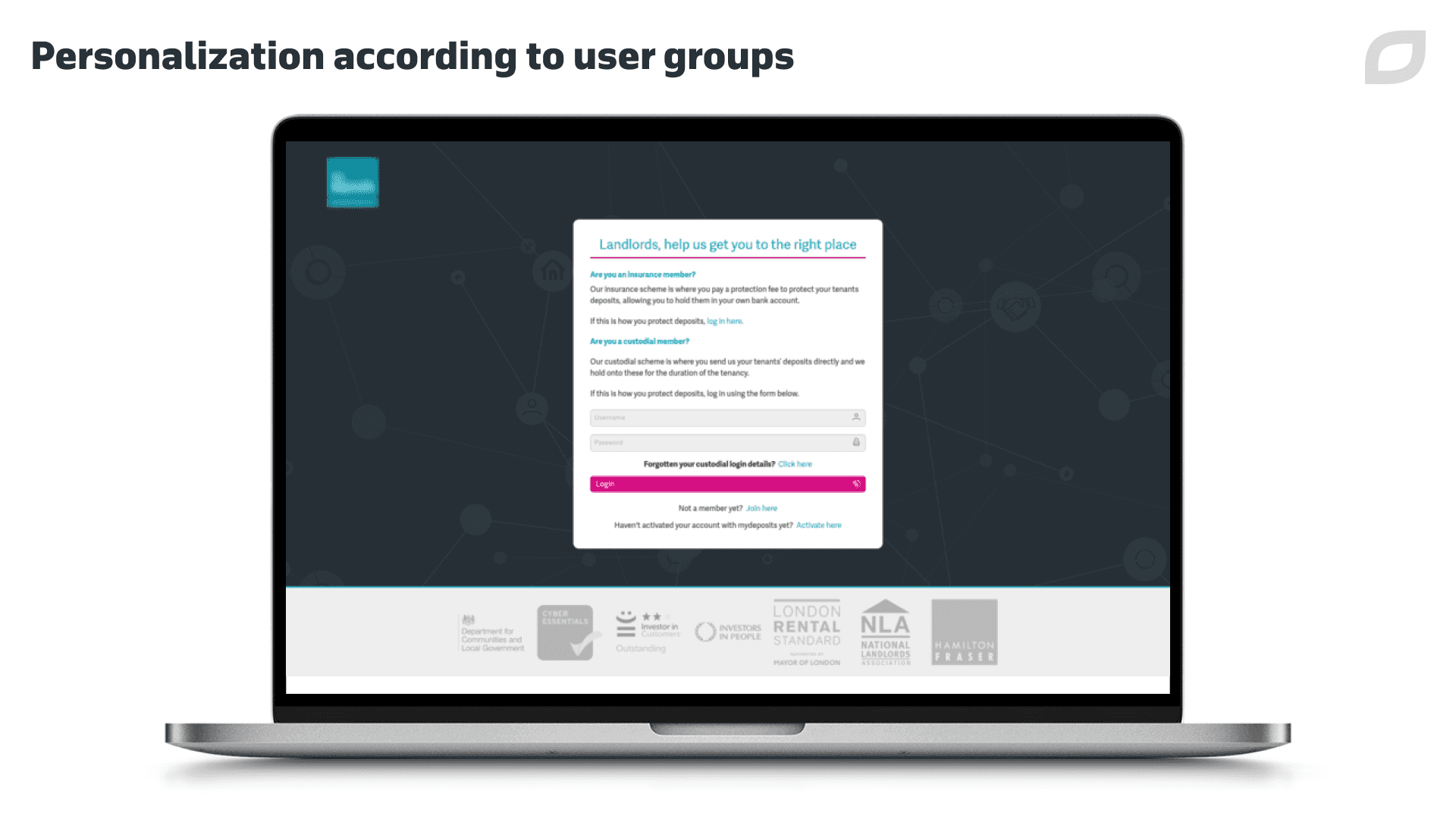

The solution features the following user roles:

- Private Landlords — individual landlords, the main users of the system, who create and protect deposits and manage properties within the system.

- Corporate Landlords — employees of companies specializing in property rentals. These users have the same capabilities as individual landlords but act on behalf of the company. Therefore, when protecting deposits, financial transactions are conducted via the company's account.

- Agents — users accepting deposits on behalf of companies or property owners. As intermediaries, these users cannot manage properties within the system.

- Tenants — users who can view their deposits and provide information in the event of disputes.

Software testing

Continuous software testing was essential to ensuring the quality of the new system. We performed functional testing, cross-browser testing, web services testing, and test automation. Based on the regression test documentation, we also created a set of nearly 1,000 test cases covering the application’s functionality.

Process improvements

Improving the development practices on the project was also part of Itransition’s mission, so we introduced the following to optimize collaboration and make it more transparent and structured:

- A unified coding style — as there were multiple vendors on the project each practicing their own coding style, there was no unified coding standard. We implemented a unified coding style based on secure coding guidelines and best software development practices.

- Transparent code review — we implemented Checkstyle on the project, reducing the time spent on code review and increasing its readability.

- Cross-review — we introduced it as the method for developers to consciously and systematically check each other’s code for mistakes. It helped us increase code quality and reduce the number of critical problems.

- Static code analysis — this was enabled with SonarQube, a tool to search for duplications, vulnerabilities, and other code issues.

Other code quality improvements included efficient logging, which became more informative and allowed developers to localize problems, and prevention of hidden technical problems during deployment.

Technologies

The SAP ecosystem is the backbone of this centralized deposit management solution. As its technological core, the SAP Commerce Cloud (formerly SAP Hybris) platform was integrated with the following products and tools:

- SAP Business ByDesign, which served as the foundation of the financial module, with a SOAP protocol implemented for information exchange.

- SecureTrading as a gateway for payments with credit and debit cards.

The total of all the employed technologies looks as follows, divided into their respective modules:

| Module | Technologies |

|---|---|

|

Presentation layer |

HTML/DHTML, JavaScript, CSS/SASS |

|

Business logic layer |

Java, SAP Commerce Cloud, Spring Framework |

|

Integration layer |

Java, WS/SOAP, Spring Integration |

| Persistence (database) layer |

SAP Commerce Cloud, MySQL |

|

Infrastructure |

Amazon Web Services (AWS), Linux |

Results

Our dedicated web development and testing team successfully integrated SAP Commerce Cloud to create a new unified tenancy deposit solution for Mydeposits. This system became a coherent integrated environment automating the retail part of the business.

Thanks to SAP Commerce Cloud integration, the customer enjoyed a 50% faster time to market. The configuration over the development concept helped the mixed team save time on flexible bespoke development and release the solution six months earlier than expected. Other benefits of implementing SAP Commerce included a 25% growth of the customer base, the ability for the company to provide a unified customer experience, and a stable, maintainable, and reliable platform for tenant deposit management.

The customer’s online product currently boasts 150K+ users, with the system securing about 1.6 million deposits and processing tens of thousands of records on a regular basis.

Services

Business process management consulting

Itransition delivers platform-based and custom BPM applications. Are you looking for the right BPM solution? Let's discuss your requirements.

Case study

An SAP Commerce-integrated mobile app for a retail chain

Get more details on how Itransition developed a mobile app for an online retail chain based on SAP Commerce.

Case study

Web performance optimization for an online retail chain

Learn how Itransition helped a leading European supplier with web performance optimization of their online supermarket.