Loan management solution

Itransition delivered a loan management solution that automated a range of manual operations, from purchase rate calculation and agreement preparation to loan processing and cancellation.

Table of contents

Challenge

Our customer, Belmont Finance, is a US-based direct sales finance organization with 15+ years in business and 300+ partners. The company had a financial platform for dealers and distributors to track their sales and process loans, but being outdated, it required a lot of manual input, was hard to modify, and didn’t support integrations with necessary third-party solutions. This way, the solution could no longer meet the company’s evolving business needs.

The customer wanted to build a new platform that would streamline loan management, help dealers to quickly submit applications and provide loans, and enable consumers to manage their accounts, obtain payoff information, or review statements. As the company was looking for a reliable software development vendor, they reached out to Itransition to discuss the project vision. Being impressed with our professional approach and expertise in custom software development, the customer entrusted the project to us.

Solution

Itransition developed a loan management platform that automates the entire loan processing flow, from application submission and reviewing to its approval or denial. In the platform, there are the following user roles:

- Consumers — users who want to buy a product and require a loan to complete the purchase.

- Distributors — organizations that offer goods for sale.

- Staff — employees performing various loan processing tasks such as reviewing consumers’ credit history, approving or denying application forms, preparing agreements, etc.

- Dealers — agents helping consumers choose a product, create a loan application form, etc.

When a customer applies for a loan, the platform, integrated with Equifax, Experian and TransUnion credit reporting agencies, automatically checks their credit history together with other necessary information and calculates their buy rate. We made calculation rules configurable, enabling the customer to make adjustments if necessary.

All applications and customer information are reviewed by the employees, who may request additional documents. If they approve the application, dealers have to prepare a loan agreement. We streamlined this process for dealers by having the platform automatically make all the necessary calculations.

Itransition also integrated the platform with Nortridge, a loan servicing solution. The platform automatically submits prepared loan agreements to Nortridge that processes loan payments and helps the consumer keep track of the amount left to pay out.

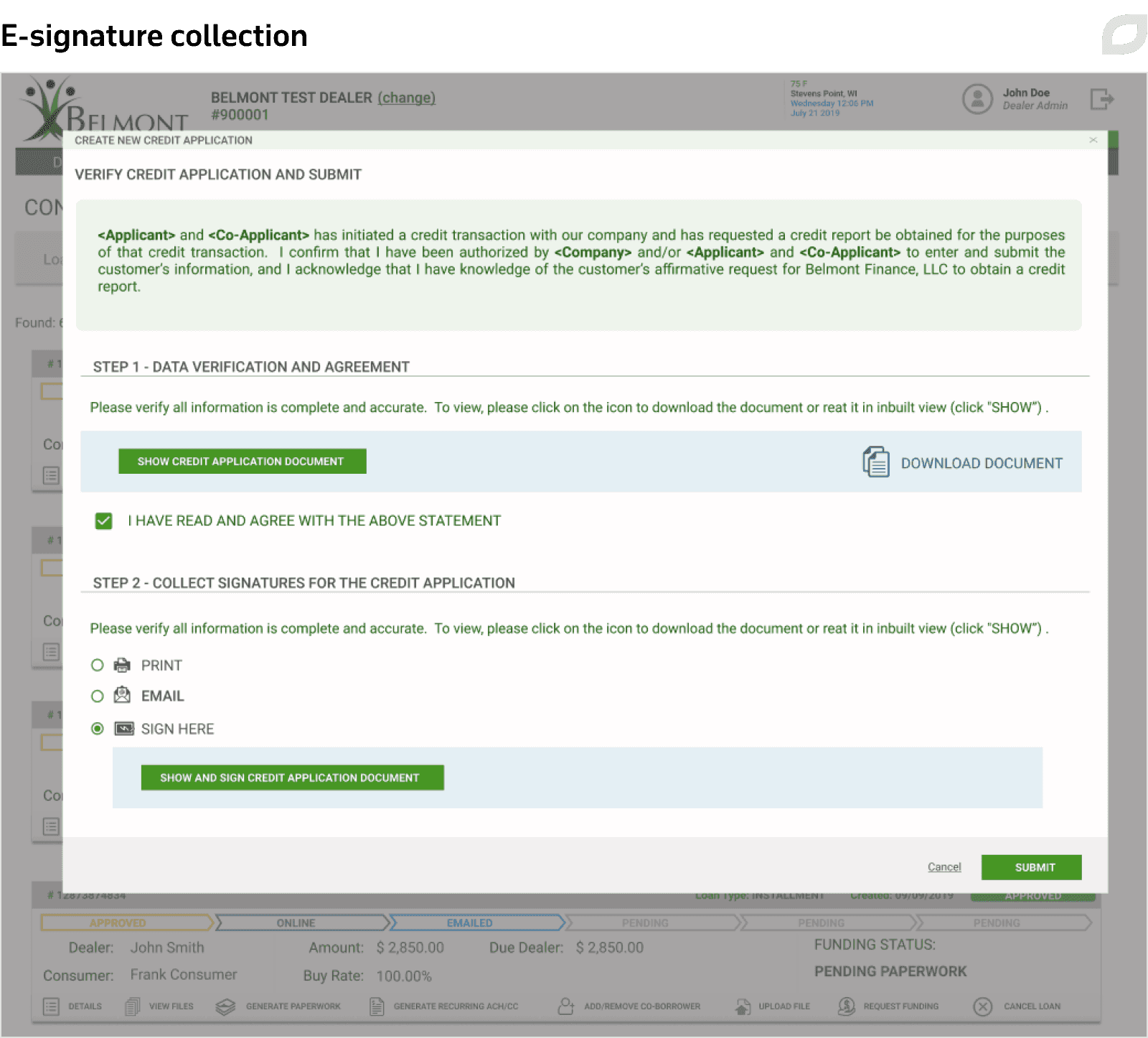

To enable customers to sign agreements online, we integrated the platform with PandaDoc software that offers the e-signature feature.

What is more, our team developed the functionality for offering promotions to distributors and consumers, which allows employees to create and configure special offers.

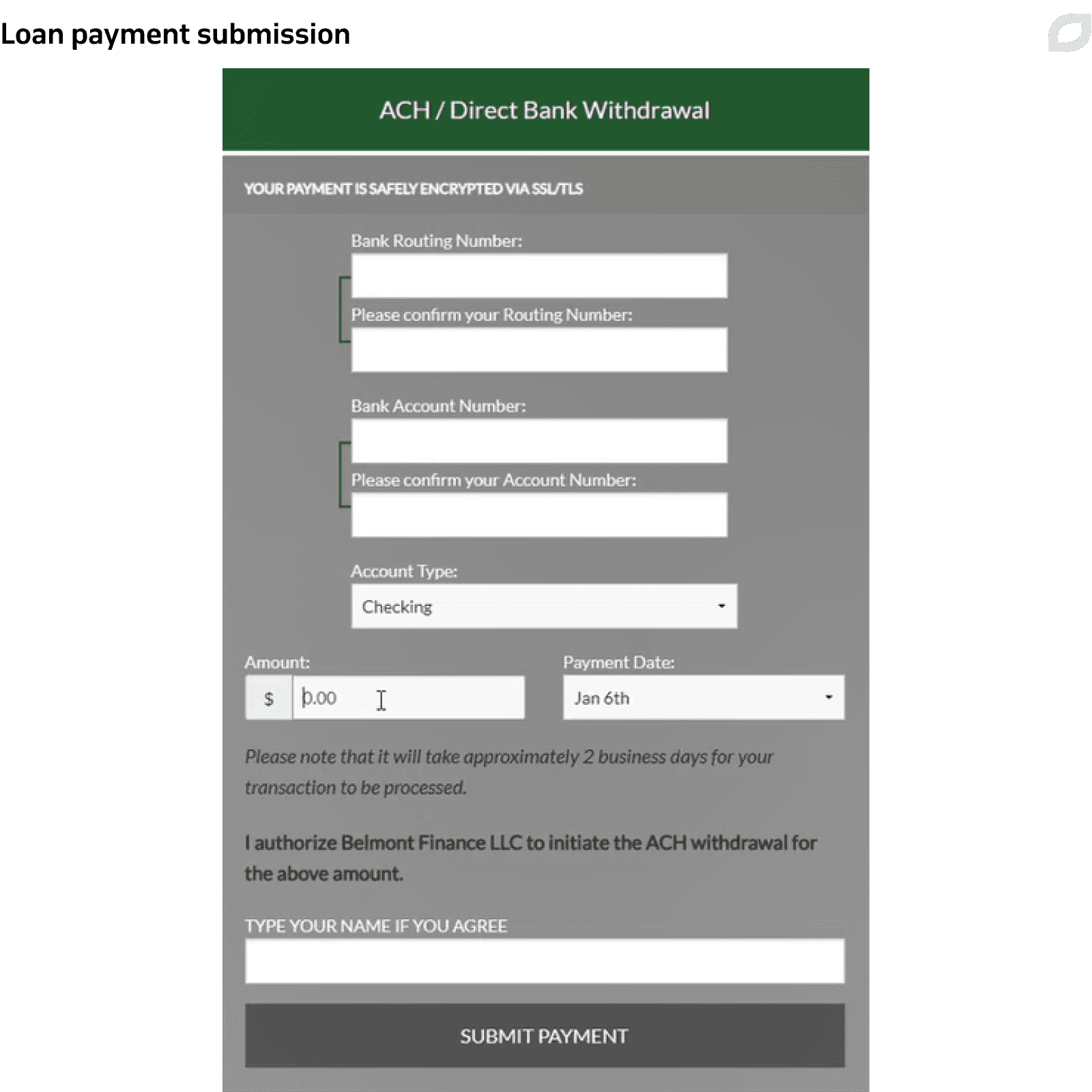

We also equipped the platform with a portal where customers can review their contracts, make card or one-time and recurring ACH payments, and more. All the payments are processed by Nortridge, and to ensure the additional security of one-time card payments, we integrated the platform with REPAY, a PCI-compliant payment processing solution.

To reduce document creation time, we implemented about 70 document templates with different tags like buyer's name, percentage rate, etc. for the platform to automatically fill in necessary data and generate a PDF document.

We set up automatic triggered and scheduled email notifications to help keep dealers and consumers up to date about their application status.

Finally, our team implemented user management capabilities into the platform, which allows authorized employees to manage user accounts, edit their data, activate and deactivate users, view statistics in a single panel. The platform can also generate detailed user reports.

Technologies

We developed the platform using .NET Core for the backend and React for the frontend. Our team applied TypeScript to ensure type safety and used the Bootstrap framework to build a responsive, mobile-first platform.

We utilized Microsoft Azure to store all platform data and applied Azure encryption keys for encryption. As a database service, we implemented Azure Database for PostgreSQL and used Azure App Service as a web hosting solution.

For third-party integrations, we used existing extensions and APIs when possible and developed custom integration solutions if no ready-made options were available.

The platform’s configuration and third-party integrations are encrypted with all passwords and tokens stored in Azure Key Vault. We also made sure that the platform is the only identity that can access the database, while other users, including administrators, can’t access the data.

Finally, to measure the solution’s performance, our team used Azure Application Insights.

Security testing

Due to the platform’s specifics, we conducted rigorous security testing. Relying on the Open OWASP Web Security Testing Guide, our QA team performed the following manual and automated security reviews and assessments:

- Information gathering. We collected all available information about the application to define its known vulnerabilities.

- Application environment assessment. We performed testing activities aimed at discovering various configuration issues.

- Access control testing. We reviewed the platform's authentication scheme and the handling and protection of session IDs.

- Input validation testing. We made sure that all data input and output is sanitized.

- Application logic testing. We ensured the application handles unexpected usage without errors and doesn’t allow bypassing the business logic schema. Additionally, we performed integrity and function-call quantity checks.

- Client-side protection testing. We confirmed that the platform is shielded from the most common client-side vulnerabilities.

Based on the test results, our QA engineers compiled a vulnerability assessment report and a security checklist.

Process

Developing the loan management solution, the Itransition team followed the Scrum methodology with two-week sprints and provided reports and product demos at the end of each sprint.

To ensure project health and prevent technical debt, we daily kept track of bugs and allocated time each sprint to fix them.

What is more, to eliminate bus factor risks and promote knowledge sharing, we established diverse knowledge-sharing practices in our team together with an internship program to quickly bring up to date new specialists joining the project.

Results

Itransition delivered a loan management solution that automates a range of manual back-office operations, from purchase rate calculation and agreement preparation to loan processing and cancellation.

Services

Financial software development services and solutions

Build a robust fintech software solution according to your business needs. Choose a trustworthy software development company as your tech partner.

Case study

Trading platform software development

Learn how Itransition developed iOS and Android applications for a European bond trader with over $1 billion raised in funds for their clients.

Case study

Billing management software for a US tax payment service provider

Learn how Itransition migrated billing management software to Microsoft Azure and enriched the solution with custom features and security updates.

Case study

Cryptocurrency exchange platform development

Itransition developed a cryptocurrency exchange platform linking bitcoin exchange accounts to allow users to trade from one web application.

Case study

Banking portal development for a large EU bank

See how Itransition handled banking portal development, redesigning an outdated internet banking app.